Loan Officer Resume Template: ATS Examples & Writing Guide [2025]

Landing a loan officer position in today’s competitive mortgage industry requires more than just experience and licensing. You need a resume that speaks the language of both applicant tracking systems and hiring managers who review hundreds of applications.

The challenge? Most loan officers struggle to translate their daily responsibilities into compelling achievement statements that demonstrate real value. You know you’re good at building client relationships and closing deals, but does your resume prove it?

By the end of this article, you’ll have everything you need to create a professional, ATS-optimized loan officer resume that showcases your expertise. We’ll walk you through each section with specific examples, explain exactly what hiring managers look for, and provide downloadable templates you can customize immediately.

☑️ Key Takeaways

- Loan officers need NMLS licensing prominently displayed alongside quantifiable loan origination volumes to stand out to hiring managers

- ATS-friendly formatting matters more than fancy designs because 83% of companies now use resume screening software to filter candidates

- Leading with a results-focused professional summary that includes specific metrics like customer satisfaction ratings and sales performance gets you past the first screening

- The optimal resume structure for loan officers prioritizes Professional Summary, Core Skills, Professional Experience, Education, and Certifications in that exact order for maximum impact

What Makes a Loan Officer Resume Different?

Loan officer resumes require a unique approach compared to other finance positions. The mortgage industry demands proof of three critical competencies: regulatory compliance knowledge, quantifiable sales performance, and relationship-building capabilities.

Your resume needs to immediately establish credibility through your NMLS license number and demonstrate your understanding of complex lending regulations. Hiring managers at banks, credit unions, and mortgage companies scan for specific keywords like TRID, RESPA, and HMDA compliance within the first six seconds of reviewing your application.

Unlike general banking roles, loan officers must showcase both analytical abilities and interpersonal skills. You’re evaluating financial documents while simultaneously counseling clients through one of the biggest decisions of their lives. Your resume should reflect this dual expertise through achievement-focused bullet points that quantify both your loan production and customer satisfaction metrics.

The structure also differs from traditional corporate resumes. Certifications and licensing information deserve prominent placement near the top, immediately following your professional summary. This positioning ensures applicant tracking systems can quickly identify your credentials while giving hiring managers instant confidence in your qualifications.

Interview Guys Tip: Front-load your resume with your strongest metrics in the professional summary and first position. Hiring managers often decide within 10 seconds whether to continue reading, so your biggest wins need to appear above the fold.

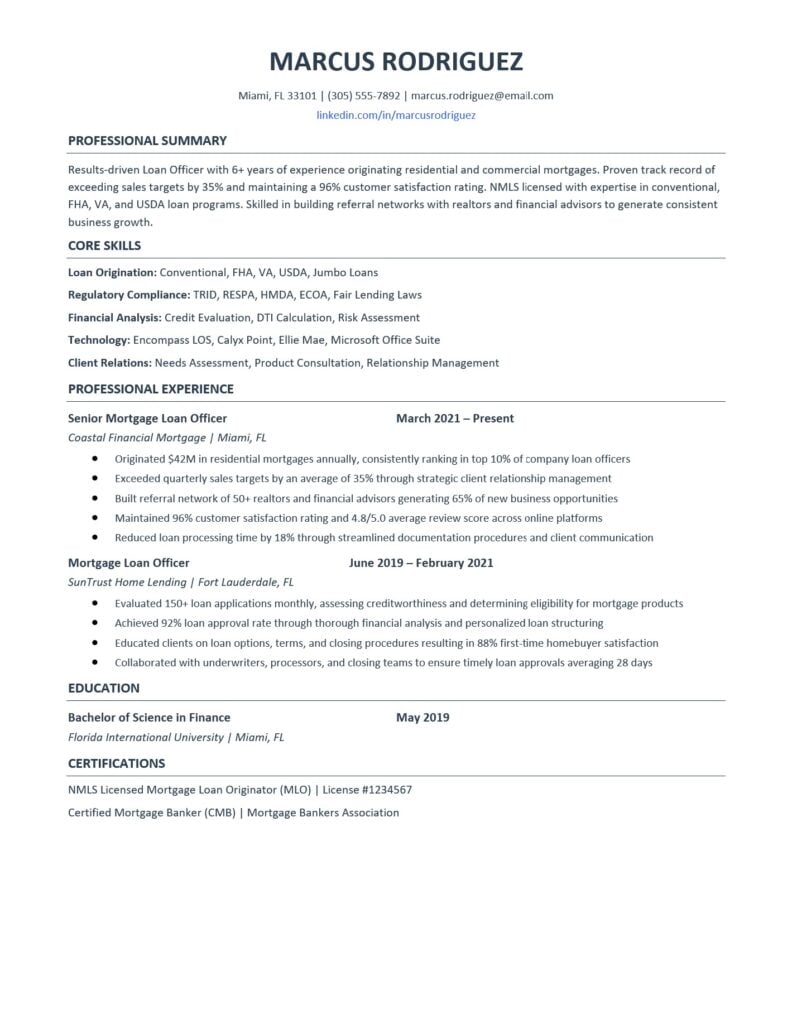

Loan Officer Resume Example

Here’s a professional loan officer resume example. This example gives you an idea of what type of content fits in a good ATS friendly resume.

Example Resume:

Here’s a professional loan officer resume template you can download and customize. This template is designed to be both visually appealing and ATS-friendly, with clean formatting that highlights your strengths.

Blank Customizable Template

Download Your Free Template:

- Download DOCX Template (fully editable in Microsoft Word)

Interview Guys Tip: The DOCX template is fully editable, allowing you to adjust fonts, colors, and spacing to match your personal brand while maintaining professional formatting. Just replace the placeholder text with your own information.

Not sure if your resume will pass the ATS?

You could have the perfect experience and still get filtered out by automated screening software. The good news? You can test your resume before you apply. Click the button to check out the ATS checker we use and recommend…

Essential Components of a Winning Loan Officer Resume

Every effective loan officer resume includes six core sections arranged in a strategic sequence. This structure guides hiring managers through your qualifications while satisfying ATS requirements.

- Professional Summary leads your resume and should span 3-4 sentences highlighting your experience level, specializations, and measurable achievements. Skip generic phrases like “detail-oriented professional” and instead focus on concrete results such as loan volumes originated, customer satisfaction ratings, or sales ranking within your company.

- Core Skills appears second and serves a dual purpose: it satisfies keyword matching algorithms while giving hiring managers a snapshot of your technical and interpersonal capabilities. Organize skills into categories such as Loan Origination, Regulatory Compliance, Financial Analysis, Technology, and Client Relations. This categorical approach makes your expertise immediately scannable.

- Professional Experience consumes the majority of your resume space and demands careful crafting. Each position should include 4-6 bullet points that follow the achievement formula: action verb + specific task + quantifiable result. For example, “Originated $42M in residential mortgages annually” outperforms “Responsible for processing loan applications.”

- Education follows your experience and typically requires just 2-3 lines. Include your degree, major, institution, and graduation date. While finance-related degrees are common, many successful loan officers enter the field through customer service or sales backgrounds, so don’t worry if your degree isn’t in finance.

- Certifications deserve their own dedicated section rather than being buried in education. Your NMLS license number must appear here, along with any additional credentials like Certified Mortgage Banker (CMB) or specialized training programs.

- Optional sections such as Professional Associations or Awards can differentiate you from other candidates. Membership in the Mortgage Bankers Association or recognition as a top producer demonstrates commitment to the profession beyond just meeting quotas.

How to Write Your Professional Summary

Your professional summary functions as an elevator pitch that determines whether hiring managers continue reading. This 3-4 sentence paragraph must immediately establish your value proposition through specific, quantifiable achievements.

Start with your years of experience and primary specialization. “Results-driven Loan Officer with 6+ years of experience originating residential and commercial mortgages” tells the reader exactly what you bring. Follow this opening with your most impressive metric, whether that’s loan volume, customer satisfaction ratings, or sales performance ranking.

Include your licensing status explicitly. “NMLS licensed with expertise in conventional, FHA, VA, and USDA loan programs” confirms you meet baseline requirements while showcasing your product knowledge breadth. This detail prevents your application from being filtered out by ATS systems searching for licensed candidates.

Close your summary with a differentiating capability or achievement. “Skilled in building referral networks with realtors and financial advisors to generate consistent business growth” demonstrates your understanding that loan origination success depends on relationship cultivation, not just processing applications.

Avoid passive language and generic descriptors. Replace “responsible for processing loans” with “originated $50M in mortgages.” Swap “excellent communication skills” for “maintained 96% customer satisfaction rating across 200+ closings.” Quantified statements carry infinitely more weight than subjective claims.

Interview Guys Tip: Tailor your professional summary to each application by incorporating 2-3 keywords from the job description. If the posting emphasizes FHA loan experience, make sure that program type appears in your summary rather than just in your skills section.

Crafting Your Core Skills Section

The Core Skills section bridges your summary and experience while serving as a keyword repository for ATS optimization. Structure this section using category headers followed by specific capabilities to create visual hierarchy while maximizing scanability.

Group skills into 5-6 categories that align with loan officer competencies:

- Loan Origination should list specific loan types you’ve handled: Conventional, FHA, VA, USDA, Jumbo Loans, or Commercial. This category immediately tells hiring managers whether your experience matches their lending focus.

- Regulatory Compliance demonstrates your understanding of the complex legal framework governing lending. Include acronyms like TRID, RESPA, HMDA, ECOA, and Fair Lending Laws. Even if you learned these concepts on the job rather than through formal training, listing them shows you understand compliance isn’t optional.

- Financial Analysis highlights your technical capabilities: Credit Evaluation, DTI Calculation, Risk Assessment, Underwriting Support, or Financial Statement Analysis. These skills prove you can assess borrower qualifications beyond just collecting documents.

- Technology matters more than ever as digital lending platforms dominate the industry. List specific loan origination systems like Encompass, Calyx Point, or Ellie Mae, along with standard tools like Microsoft Office Suite or CRM platforms.

- Client Relations rounds out your skill set with interpersonal capabilities: Needs Assessment, Product Consultation, Relationship Management, or Referral Network Development. These softer skills differentiate high-performing loan officers from transactional processors.

When selecting skills to include, review the job description carefully and prioritize capabilities that appear in the posting. If an employer emphasizes VA loan experience three times, make sure VA loans appear in your Loan Origination category rather than buried in a bullet point. Need help identifying the right skills for your resume? We’ve got you covered.

Building Powerful Professional Experience Bullet Points

Your Professional Experience section requires the most strategic effort because it carries the greatest weight in hiring decisions. Every bullet point should follow the achievement formula: specific action + measurable result + business impact.

Bad bullet points focus on responsibilities: “Processed loan applications and assisted customers with paperwork.” This describes what you did without demonstrating value or impact.

Strong bullet points quantify achievements: “Originated $42M in residential mortgages annually, consistently ranking in top 10% of company loan officers.” This version shows volume, performance relative to peers, and sustained excellence.

Include 4-6 bullet points per position, prioritizing recent roles over older positions. Your current or most recent job deserves the most detail since it best represents your current capabilities. Positions from 10+ years ago can be condensed to 2-3 bullets or even summarized in a single line.

Lead each bullet with a strong action verb: Originated, Evaluated, Cultivated, Exceeded, Streamlined, or Maintained. These verbs create active voice that makes your accomplishments pop off the page. Avoid weak verbs like “helped,” “worked on,” or “was responsible for.”

Quantify everything possible. Instead of “exceeded sales targets,” write “exceeded quarterly sales targets by an average of 35%.” Rather than “built referral network,” specify “built referral network of 50+ realtors generating 65% of new business opportunities.”

Customer satisfaction metrics matter tremendously in loan officer roles. If you track NPS scores, online reviews, or client retention rates, include these figures: “Maintained 96% customer satisfaction rating and 4.8/5.0 average review score across online platforms.”

Process improvements demonstrate initiative beyond just originating loans. “Reduced loan processing time by 18% through streamlined documentation procedures” shows you think about efficiency and client experience, not just closing deals.

When you prepare for interviews (check out our guide to common loan officer interview questions), these quantified achievements become the foundation for your SOAR Method responses about your accomplishments.

Education and Certification Guidelines

Education requirements for loan officers vary significantly by employer and specialization. While many loan officers hold bachelor’s degrees in finance, business, or economics, formal education matters less than licensing and demonstrated performance in this field.

Format your education section with degree type and major on the first line, followed by institution and location on the second line, with graduation date right-aligned. If your GPA was 3.5 or higher, you can include it, but this detail becomes less relevant beyond your first five years in the industry.

Skip high school information entirely unless you’re an entry-level candidate without college experience. In that case, listing relevant coursework or certifications can demonstrate your foundational knowledge despite the lack of a degree.

The Certifications section carries more weight than education for loan officers because licensing directly determines your ability to perform the job. Your NMLS license number must appear prominently with your full license title: “NMLS Licensed Mortgage Loan Originator (MLO) | License #1234567.”

Additional certifications like Certified Mortgage Banker (CMB) from the Mortgage Bankers Association demonstrate advanced expertise and professional commitment. Specialized training in areas like reverse mortgages, commercial lending, or construction loans can differentiate you in competitive markets.

List certifications with the credential name first, followed by the issuing organization and date received if recent. Unlike education which remains static, certifications signal ongoing professional development and industry engagement.

Common Loan Officer Resume Mistakes to Avoid

Even experienced loan officers make critical resume errors that cost them interviews. The most damaging mistake is failing to quantify achievements, leaving hiring managers to guess at your actual performance level.

- Generic responsibilities like “processed loan applications” or “worked with clients” tell the reader nothing about your effectiveness. These vague statements suggest you either didn’t track your performance or achieved unremarkable results. Transform every responsibility into an achievement by adding numbers: loan volume, approval rates, customer satisfaction scores, or sales rankings.

- Neglecting ATS optimization ranks as the second most common error. When you use graphics, tables, or creative formatting, applicant tracking systems often can’t parse your information correctly. Your beautifully designed resume becomes unreadable to the software screening applications before human eyes ever see it.

- Missing or buried NMLS license information immediately disqualifies your application at many lenders. Licensing isn’t just a nice-to-have detail, it’s a legal requirement for mortgage loan originators. Place your license number prominently in your certifications section and consider including it in your resume header or professional summary.

- Listing duties instead of accomplishments throughout your experience section makes your resume indistinguishable from dozens of other applications. Remember that hiring managers already know what loan officers do generally. They want to understand what you specifically achieved and how you outperformed your peers.

- Including irrelevant work history beyond 10-15 years clutters your resume without adding value. Your experience as a retail manager 20 years ago doesn’t strengthen your loan officer candidacy. Focus on recent, relevant positions and condense or eliminate older roles.

- Typos and grammatical errors signal carelessness that’s particularly damaging for positions requiring attention to detail. Loan officers handle complex financial documents and regulatory compliance; errors on your resume suggest you might be equally sloppy with loan applications.

For more resume guidance, explore our comprehensive article on how to make a resume that stands out to employers.

ATS Optimization and Keywords

Applicant tracking systems filter 75% of resumes before human review, making ATS optimization non-negotiable for loan officer applications. These software platforms scan for specific keywords, proper formatting, and relevant qualifications to determine which candidates advance.

Understanding how ATS works helps you structure content effectively. The software parses your resume into discrete fields: contact information, work history, education, skills, and certifications. When you use unusual formatting like text boxes, headers/footers, or tables, the ATS often misinterprets or completely misses critical information.

Stick to standard section headings that ATS systems recognize: Professional Experience (not “Where I’ve Worked”), Education (not “Academic Background”), and Skills (not “What I Bring to the Table”). These conventional labels help the software correctly categorize your information.

Keywords fall into three categories for loan officers: technical skills, soft skills, and regulatory knowledge. Technical skills include specific loan types (FHA, VA, USDA, conventional), software platforms (Encompass, Calyx Point, Ellie Mae), and financial concepts (debt-to-income ratio, loan-to-value ratio, underwriting).

Soft skills matter because loan officers need both analytical and interpersonal capabilities. Include terms like relationship building, client consultation, needs assessment, and communication. Don’t just list these skills in isolation; demonstrate them through your achievement statements.

Regulatory keywords show you understand the compliance framework: TRID, RESPA, HMDA, ECOA, Fair Lending Laws, and NMLS. Even if you learned compliance through on-the-job training rather than formal coursework, these acronyms prove you can navigate the regulatory environment.

Interview Guys Tip: Create a master resume containing every relevant keyword and accomplishment, then customize it for each application by emphasizing the 8-10 keywords that appear most frequently in the job description. This targeting approach increases your ATS match score while keeping your resume authentic to your experience.

File format matters for ATS compatibility. Submit your resume as a .docx file rather than PDF unless the application specifically requests PDF. While modern ATS systems handle PDFs better than older versions, .docx files remain the safest choice for ensuring your information is correctly parsed.

Interview Guys Tip: Before you submit another application, run your resume through an ATS scanner. Most job seekers skip this step and wonder why they never hear back. Check out the free ATS checker we use and recommend →

Frequently Asked Questions

How long should my loan officer resume be?

One page works best for loan officers with fewer than 10 years of experience, while two pages is acceptable for senior professionals with extensive track records. Focus on quality over quantity by including only your most impressive achievements rather than exhaustively listing every duty you’ve ever performed.

Should I include my NMLS license number on my resume?

Absolutely yes. Your NMLS license number belongs in your Certifications section and can also appear in your resume header or professional summary. This information is mandatory for mortgage loan originators and immediately establishes your credibility. Omitting it raises red flags about your licensing status.

What’s the best way to describe loan volume achievements?

Use annual figures when discussing loan origination volume: “Originated $42M in residential mortgages annually.” This standardization allows hiring managers to quickly compare your performance to their expectations and other candidates. Include both dollar volume and number of loans when possible: “Closed 180 loans worth $42M annually.”

How do I address employment gaps on my loan officer resume?

Brief gaps (3-6 months) can often be handled through year-only date formatting. Longer gaps benefit from brief explanatory context in your cover letter rather than on your resume. If you completed relevant certifications, training, or volunteer work during the gap, create a section highlighting these activities to show continued professional development. For more detailed strategies, read our guide on career gap strategies.

Should I customize my resume for each loan officer application?

Yes, especially when you’re targeting different types of lending institutions or loan specializations. A resume for a commercial loan officer position should emphasize business lending experience, while a residential mortgage application should highlight home loan expertise. Review the job description for keywords and prioritize relevant accomplishments that match the employer’s specific needs. Learn more about tailoring your resume effectively.

Your Next Steps

You now have everything you need to create a loan officer resume that gets interviews: proven templates, specific examples, ATS optimization strategies, and section-by-section guidance.

Start by downloading our templates and customizing them with your specific achievements. Replace placeholder text with your quantified results, ensuring every bullet point demonstrates measurable impact rather than just listing responsibilities.

Remember to emphasize your NMLS licensing prominently and include specific keywords from each job description you’re targeting. The most successful loan officers don’t send generic resumes to every opening. They strategically customize their applications to match each employer’s specific needs and priorities.

Once your resume is ready, pair it with a compelling cover letter that expands on your key achievements and explains why you’re specifically interested in that lender or position. Need more job search resources? Browse our free resume template library for additional formats and styles.

Your resume is just the first step toward landing your next loan officer role. When interview invitations start arriving, make sure you’re prepared to discuss your achievements in depth using our complete guide on preparing for job interviews. You’ve got this!

Over 75% of resumes get rejected by ATS software before a human ever sees them…

The good news? You can test your resume before you apply. Want to know where you stand? Test your resume with our recommended ATS scanner →

BY THE INTERVIEW GUYS (JEFF GILLIS & MIKE SIMPSON)

Mike Simpson: The authoritative voice on job interviews and careers, providing practical advice to job seekers around the world for over 12 years.

Jeff Gillis: The technical expert behind The Interview Guys, developing innovative tools and conducting deep research on hiring trends and the job market as a whole.