Free Accounting Resume Template: ATS-Friendly Examples & Writing Guide (2025)

You’re Qualified, But Your Resume Isn’t Getting You Interviews

You’ve got the CPA credentials, years of experience with QuickBooks and SAP, and a track record of closing books on time. Yet your inbox stays frustratingly quiet after submitting application after application.

Here’s the harsh truth: your qualifications don’t matter if your resume can’t survive the first 7 seconds of a recruiter’s scan or the automated filtering of an Applicant Tracking System. With over 300,000 accountants leaving the profession in recent years and competition fiercer than ever, your resume needs to work harder than you do during tax season.

The good news? A well-structured, ATS-friendly accounting resume can be your ticket to landing interviews at the companies you actually want to work for. This guide provides you with free downloadable DOCX templates, proven strategies, and real examples that showcase exactly what hiring managers and ATS systems are looking for in 2025.

By the end of this article, you’ll have access to professional resume templates specifically designed for accounting roles, plus the knowledge to customize them for maximum impact. Let’s get you from qualified candidate to interview-ready professional.

☑️ Key Takeaways

- ATS optimization is non-negotiable for accounting resumes, with over 98% of companies using automated screening to filter candidates before human review

- Quantified achievements beat generic duties every time—accountants who include specific metrics (cost savings, efficiency gains, error reductions) see significantly higher callback rates

- Strategic section ordering matters in 2025—Professional Summary, Core Skills, Experience, Education, and Certifications is the proven formula that passes ATS and impresses hiring managers

- The right template saves hours and ensures your resume meets both technical ATS requirements and professional formatting standards that accounting employers expect

What Makes an Accounting Resume Different in 2025?

Accounting resumes in 2025 face unique challenges that other professions don’t encounter. According to recent data, employment of accountants is projected to grow 6% from 2023 to 2033, but the way companies hire has fundamentally changed.

First, there’s the ATS gauntlet. These systems scan for specific keywords matching the job description. Miss the right terms like “GAAP compliance,” “month-end close,” or “SOX audit,” and your resume gets automatically rejected before a human ever sees it.

Second, accounting employers expect precision. A single typo or formatting inconsistency on your resume signals the opposite of what you want to convey. When you’re applying to manage someone’s finances, your resume needs to demonstrate the same attention to detail you’d bring to their books.

Third, quantification is king. Generic statements like “responsible for accounts payable” tell employers nothing. But “managed AP for 200+ vendors with 98% accuracy rate” proves your capability with concrete evidence.

The accounting resumes that win in 2025 balance three critical elements: ATS optimization with proper keywords, professional formatting that showcases your organizational skills, and quantified achievements that prove your value.

Interview Guys Tip: Use the exact job title from the posting in your resume when it matches your experience. If they’re hiring a “Senior Financial Accountant” and you write “Senior Accounting Specialist,” the ATS might not recognize the match, even if the roles are identical.

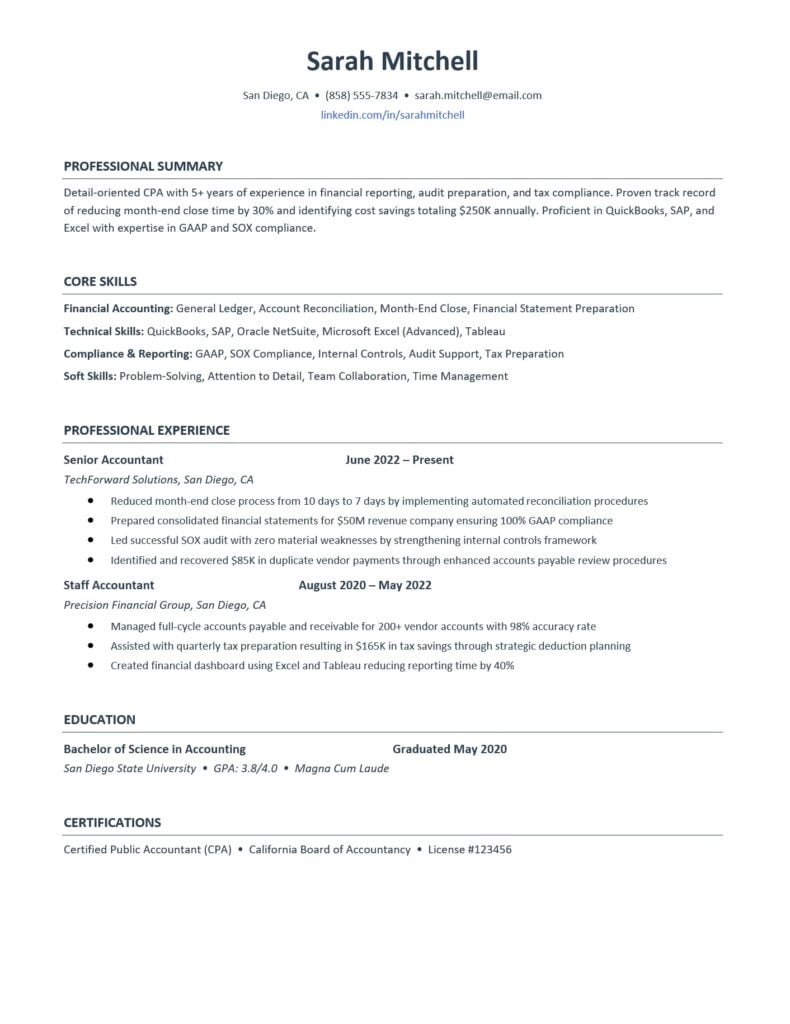

Accounting Resume Example

Here’s a professional accountant resume example. This example gives you an idea of what type of content fits in a good ATS friendly resume.

Example Resume:

Here’s a professional accountant resume template you can download and customize. This template is designed to be both visually appealing and ATS-friendly, with clean formatting that highlights your strengths.

Blank Customizable Template

Download Your Free Template:

- Download DOCX Template (fully editable in Microsoft Word)

Interview Guys Tip: The DOCX template is fully editable, allowing you to adjust fonts, colors, and spacing to match your personal brand while maintaining professional formatting. Just replace the placeholder text with your own information.

Over 75% of resumes get rejected by ATS software before a human ever sees them…

The good news? You can test your resume before you apply. Want to know where you stand? Test your resume with our recommended ATS scanner →

Essential Components of an ATS-Friendly Accounting Resume

Your accounting resume needs six core sections in this specific order: Contact Information, Professional Summary, Core Skills, Professional Experience, Education, and Certifications. This structure isn’t arbitrary; it’s based on what both ATS systems and hiring managers scan for first.

Contact Information

Keep it simple: name, location (city and state), phone number, email, and LinkedIn URL. Your email should be professional; recruiters report immediately discarding resumes with unprofessional email addresses. Skip physical addresses and focus on digital contact methods.

Professional Summary

This 2-3 sentence section sits at the top and serves as your elevator pitch. It should include your years of experience, key specializations (tax, audit, financial reporting), technical proficiencies, and one standout achievement. The summary answers the critical question: “Why should we keep reading?”

For example: “Detail-oriented CPA with 5+ years of experience in financial reporting, audit preparation, and tax compliance. Proven track record of reducing month-end close time by 30% and identifying cost savings totaling $250K annually. Proficient in QuickBooks, SAP, and Excel with expertise in GAAP and SOX compliance.”

Core Skills Section

This is your ATS keyword goldmine. Organize skills into categories: Financial Accounting (general ledger, reconciliation, month-end close), Technical Skills (specific software), Compliance & Reporting (GAAP, SOX, tax), and Soft Skills (problem-solving, collaboration).

According to industry experts, including both the full names and acronyms of certifications and software helps catch different keyword variations. Write both “Generally Accepted Accounting Principles (GAAP)” and “GAAP” separately throughout your resume.

Professional Experience

This is where you prove your value. List positions in reverse chronological order with 3-4 bullet points per role. Each bullet should follow this formula: action verb + specific task + measurable result.

Bad: “Responsible for preparing financial statements” Good: “Prepared consolidated financial statements for $50M revenue company ensuring 100% GAAP compliance”

The difference? Specificity and impact. You can learn more about crafting powerful achievement statements in our guide on resume achievement formulas.

Interview Guys Tip: When describing your accomplishments, use the past tense for previous roles and present tense only for your current position. This subtle grammar choice keeps your resume professional and easy to follow.

Education

For accounting roles, your education matters. List your degree, school name, graduation date, and GPA if it’s 3.5 or higher. If you’re a recent graduate, you can also include relevant coursework like Advanced Financial Accounting or Taxation. Experienced professionals should keep this section brief.

Certifications

Accounting certifications deserve their own dedicated section. List your CPA, CMA, CIA, or other relevant credentials with the issuing organization and license number. These certifications often serve as hard requirements in job postings, making them critical for passing ATS screening.

How to Write Each Section for Maximum Impact

Crafting Your Professional Summary

Your summary should read like a confident introduction at a networking event. Start with your title and experience level, highlight your specialization areas, mention 2-3 technical proficiencies, and close with a standout metric.

Avoid vague statements like “hard-working accountant seeking opportunities.” Instead, be specific: “Tax accountant with 7 years of experience specializing in corporate tax compliance for Fortune 500 clients. Expert in federal and state tax regulations with a track record of securing $2M+ in tax savings through strategic planning.”

Building Your Core Skills

Your skills section needs strategic keyword placement. Review the job description and identify required skills, then mirror that language in your resume. If they want “Oracle NetSuite experience,” don’t write “ERP system proficiency.”

Research shows that including both hard and soft skills gives you the best chance of passing ATS while impressing human reviewers. Technical skills like software proficiency and accounting standards prove your capability, while soft skills like “cross-functional collaboration” show you can work well in teams.

Writing Powerful Experience Bullets

Each experience bullet should tell a mini-story of impact. Start with strong action verbs: managed, implemented, streamlined, reduced, increased, led, optimized. Follow with specific details about what you did, then close with the measurable result.

Here’s the pattern: “Implemented automated reconciliation process, reducing month-end close time from 10 days to 7 days and saving 120 hours annually.”

Notice how this bullet includes the action (implemented), the specifics (automated reconciliation process), and the dual metrics (time reduction and efficiency gain). This is what separates amateur resumes from professional ones. For more examples of effective formatting, check out our resume formatting guide.

Highlighting Education and Certifications

For recent graduates, your education section can include honors, relevant coursework, and academic achievements. List courses like Financial Statement Analysis, Cost Accounting, or Audit & Assurance if you’re light on work experience.

For experienced professionals, keep education simple: degree name, school, year. Your work accomplishments should dominate the page.

Certifications require special attention. The CPA credential alone can increase your earning potential significantly and often serves as a mandatory requirement. List the full certification name, the issuing body, your license number, and the year obtained. If you’re in the process of earning a certification, note “CPA candidate, expected 2025.”

Common Mistakes That Get Accounting Resumes Rejected

The fastest way to land in the rejection pile? Making any of these critical errors.

- Using Graphics or Tables: ATS systems can’t parse images, text boxes, or complex tables. That beautiful infographic resume template? It’s unreadable to the software that screens 98% of applications. Stick to simple text formatting with clear section headers.

- Generic Job Descriptions: Copying and pasting job responsibilities from your official job description wastes valuable space. Employers know what accountants do; they want to know what you specifically accomplished. “Prepared journal entries” tells them nothing. “Identified and corrected $85K in duplicate vendor payments” proves your value.

- Missing Keywords: According to recent analysis, recruiters spend just 7.4 seconds reviewing each resume. If your resume doesn’t immediately show you have the required skills, you’re done. Read the job posting carefully and include must-have keywords naturally throughout your resume.

- Exceeding One Page: Unless you have 10+ years of highly relevant experience, keep your resume to one page. Hiring managers appreciate conciseness. Every line should earn its place by demonstrating value.

- Typos and Errors: Nothing undermines your credibility faster than errors on an accounting resume. Proofread obsessively, use spell-check, and have someone else review it. A single mistake can cost you the interview.

Interview Guys Tip: Before submitting your resume, copy the text into a basic text editor to check for weird formatting issues. Sometimes invisible characters or unusual spacing that looks fine in Word can confuse ATS systems.

ATS Optimization and Keywords for Accounting Resumes

Understanding how Applicant Tracking Systems work is the difference between getting interviews and wondering why your applications disappear into the void.

ATS software scans your resume for keywords that match the job description. It’s looking for specific skills, software names, certifications, and industry terms. The system assigns you a score based on keyword matches, then ranks candidates accordingly.

For accounting roles, critical keywords typically include:

- Software and Systems: QuickBooks, SAP, Oracle NetSuite, Microsoft Excel, Tableau, Power BI, Sage Intacct, Xero

- Accounting Standards and Compliance: GAAP (Generally Accepted Accounting Principles), IFRS, SOX compliance, internal controls, audit preparation

- Core Functions: General ledger, accounts payable, accounts receivable, month-end close, financial reporting, reconciliation, journal entries, variance analysis

- Specializations: Tax preparation, cost accounting, financial analysis, budgeting, forecasting, payroll processing

- Certifications: CPA (Certified Public Accountant), CMA (Certified Management Accountant), CIA (Certified Internal Auditor)

The key to ATS success isn’t keyword stuffing. Instead, naturally incorporate these terms throughout your resume, especially in your skills section and experience bullets. If the job posting emphasizes “GAAP compliance” three times, make sure that phrase appears in your resume too.

One often-overlooked strategy: use both acronyms and full terms. Write “Certified Public Accountant (CPA)” once, then use “CPA” elsewhere. Some ATS systems search for full names while others look for acronyms.

Interview Guys Tip: Before you submit another application, run your resume through an ATS scanner. Most job seekers skip this step and wonder why they never hear back. Check out the free ATS checker we use and recommend →

Frequently Asked Questions

Should I include my GPA on my accounting resume?

Include your GPA only if you graduated within the last 3 years and earned 3.5 or higher. For experienced professionals, your work accomplishments matter far more than academic performance. Remove your GPA once you have 2-3 years of solid work experience to showcase.

How far back should my work history go?

The standard rule is 10-15 years. Anything older than that becomes less relevant and takes up valuable space. Focus on recent, impactful positions that showcase skills relevant to the role you’re targeting. If you’re applying to learn how to prepare for a job interview, make sure your most recent experience aligns with the position.

Do I need a different resume for different accounting roles?

Absolutely. A resume for a tax accountant position should emphasize different skills and experiences than one for a cost accountant or auditor role. Customize your professional summary, skills section, and experience bullets to match each specific job description. This targeted approach dramatically improves your ATS score and shows employers you’re genuinely interested in their specific role.

What if I’m changing careers into accounting?

Focus your resume on transferable skills. If you’re coming from finance, operations, or data analysis, highlight skills like financial modeling, Excel proficiency, data accuracy, and analytical thinking. Use your professional summary to explain your transition and emphasize any relevant coursework or certifications you’ve completed.

Should I include volunteer work or side projects?

Yes, especially if you’re early in your career or changing industries. Volunteer treasurer work, financial consulting for nonprofits, or personal finance projects all demonstrate relevant skills. Just make sure to quantify your impact wherever possible.

Your Next Steps to Resume Success

You now have everything you need to create an accounting resume that gets past ATS systems and impresses hiring managers. The templates provided give you the professional structure and formatting that employers expect, while the strategies in this guide help you customize every section for maximum impact.

Remember the fundamentals: quantify your achievements, use industry-specific keywords naturally, keep formatting simple and ATS-friendly, and tailor every application to the specific role. Your resume isn’t just a list of past jobs; it’s a marketing document that proves you’re the solution to an employer’s problem.

Download your free accounting resume templates in DOCX format today and start customizing them for your next application. With the right foundation and targeted customization, you’ll transform your job search from frustrating to successful.

Looking for more resume resources? Browse our complete collection of free resume templates for every industry and career level. Your next interview is just one great resume away.

Not sure if your resume will pass the ATS?

You could have the perfect experience and still get filtered out by automated screening software. The good news? You can test your resume before you apply. Click the button to check out the ATS checker we use and recommend…

BY THE INTERVIEW GUYS (JEFF GILLIS & MIKE SIMPSON)

Mike Simpson: The authoritative voice on job interviews and careers, providing practical advice to job seekers around the world for over 12 years.

Jeff Gillis: The technical expert behind The Interview Guys, developing innovative tools and conducting deep research on hiring trends and the job market as a whole.