Free Accounts Receivable Resume Template 2025: ATS Friendly Examples & Writing Guide

Your accounts receivable resume isn’t just landing in a hiring manager’s inbox anymore. It’s getting scanned by applicant tracking systems, analyzed by AI tools, and competing against hundreds of other applications. One small formatting mistake or missing keyword could mean your years of experience managing collections and reconciling accounts never gets seen.

That’s exactly what happened to a friend of mine with eight years of AR experience. She applied to 47 positions without a single callback. The problem wasn’t her qualifications. It was her resume format that ATS systems couldn’t parse correctly.

Here’s the good news: an effective accounts receivable resume follows a specific formula that works with both software and human reviewers. By the end of this article, you’ll have access to a free, professionally designed template and know exactly how to showcase your invoicing expertise, collection achievements, and technical skills in a way that gets interviews.

Want to make sure your broader job search strategy is working? Check out our guide to common job application mistakes that could be holding you back.

☑️ Key Takeaways

- Accounts receivable resumes need quantifiable metrics like DSO reduction percentages and collection rates to stand out

- ATS-friendly formatting is critical since 98% of large organizations use applicant tracking systems to filter candidates

- Technical proficiency in AR software (QuickBooks, SAP, Oracle) should be prominently displayed alongside soft skills

- The optimal resume structure for AR roles prioritizes skills and achievements over generic job descriptions

What Makes an Accounts Receivable Resume Different?

Accounts receivable specialists need resumes that speak two languages: the technical language of accounting systems and the business language of cash flow management. Your resume needs to demonstrate you’re equally comfortable running aging reports in QuickBooks and negotiating payment terms with difficult clients.

The most successful AR resumes share three characteristics. First, they quantify everything. Instead of “managed customer accounts,” you write “managed 500+ customer accounts totaling $12M in annual revenue.” Second, they showcase technical proficiency prominently because 98% of large organizations use ATS to filter candidates. Third, they balance hard accounting skills with soft skills like communication and problem-solving.

Interview Guys Tip: Most AR positions require specific software experience. If the job posting mentions QuickBooks, SAP, or Oracle NetSuite, those exact program names need to appear in your skills section. ATS systems look for exact keyword matches.

Unlike generic accounting resumes, your AR-focused resume should emphasize cash flow improvement metrics. Hiring managers want to see that you’ve reduced Days Sales Outstanding (DSO), improved collection rates, or decreased bad debt write-offs. These metrics directly impact a company’s bottom line.

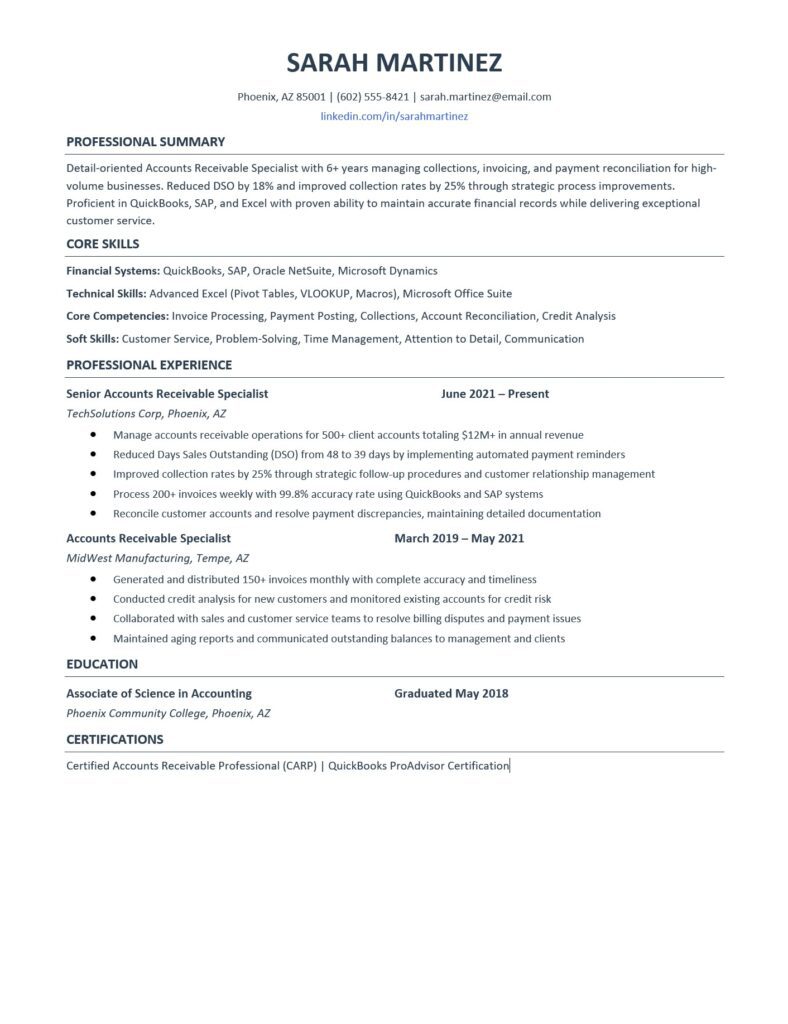

Accounts Receivable Resume Example

Here’s a professional accounts receivable resume example. This example gives you an idea of what type of content fits in a good ATS friendly resume.

Example Resume:

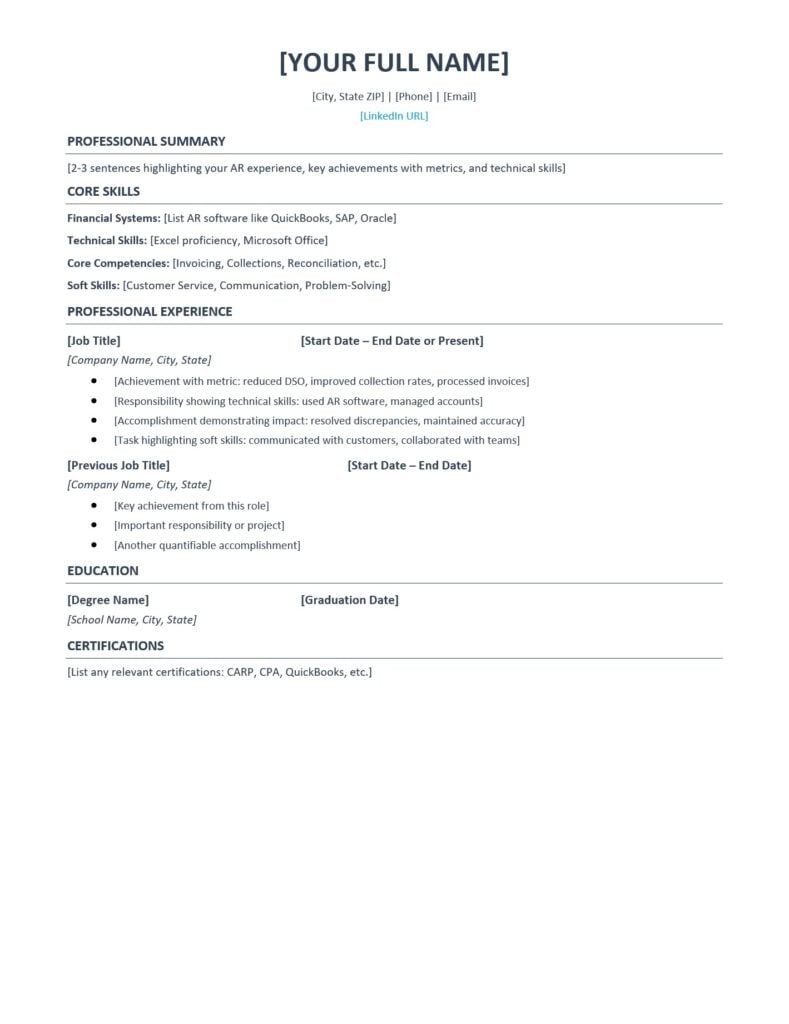

Here’s a professional resume template you can download and customize. This template is designed to be both visually appealing and ATS-friendly, with clean formatting that highlights your strengths.

Blank Customizable Template

Download Your Free Template:

- Download DOCX Template (fully editable in Microsoft Word)

Interview Guys Tip: The DOCX template is fully editable, allowing you to adjust fonts, colors, and spacing to match your personal brand while maintaining professional formatting. Just replace the placeholder text with your own information.

Over 75% of resumes get rejected by ATS software before a human ever sees them…

The good news? You can test your resume before you apply. Want to know where you stand? Test your resume with our recommended ATS scanner →

Essential Components of an Accounts Receivable Resume

The structure matters just as much as the content. Based on analysis of what gets candidates hired in 2025, your AR resume should follow this order: header with contact information, professional summary, core skills section, professional experience, education, and certifications.

Your header needs to be simple and ATS-readable. Include your full name, city and state, phone number, email address, and LinkedIn URL. Skip the street address (it takes up valuable space) and never include a photo, which has an 88% rejection rate according to resume statistics.

The professional summary is your 30-second elevator pitch in writing. This 2-3 sentence paragraph should immediately tell hiring managers your years of experience, biggest achievement metrics, and key technical skills. For example: “Detail-oriented Accounts Receivable Specialist with 6+ years managing collections for high-volume businesses. Reduced DSO by 18% and improved collection rates by 25% through process improvements. Expert in QuickBooks, SAP, and advanced Excel.”

Interview Guys Tip: Your core skills section should be organized into categories: Financial Systems, Technical Skills, Core Competencies, and Soft Skills. This organization helps ATS systems parse your information correctly while making it scannable for human reviewers.

Looking to strengthen your overall application? Our resume summary examples guide shows you how to craft compelling opening statements.

Writing Each Section: Professional Experience

This section makes or breaks your resume. Each job entry should follow the same format: job title with dates right-aligned, company name and location in italics, then 3-5 bullet points highlighting achievements.

Start every bullet point with a strong action verb. Instead of “responsible for invoice processing,” write “processed 200+ invoices weekly with 99.8% accuracy rate.” The difference is dramatic. The first version tells what you were supposed to do. The second proves what you actually accomplished.

The best AR resume bullets follow a specific formula: action verb + task + quantifiable result. Here are examples that work:

- “Reduced Days Sales Outstanding (DSO) from 48 to 39 days by implementing automated payment reminders”

- “Improved collection rates by 25% through strategic follow-up procedures and relationship management”

- “Managed accounts receivable operations for 500+ client accounts totaling $12M+ in annual revenue”

- “Generated and distributed 150+ invoices monthly with complete accuracy and timeliness”

Notice how each bullet includes specific numbers. This matters because candidates who quantify achievements on resumes are 40% more likely to land interviews.

When describing your collection efforts, focus on results rather than tasks. Don’t write “contacted customers about overdue payments.” Instead, write “recovered $240K in aged receivables through diplomatic customer communication and payment plan negotiations.”

Need help crafting achievement-focused bullets? Check out our resume achievement formulas for more examples.

Technical Skills and Software Proficiency

The technical skills section deserves special attention in AR resumes. According to industry job posting analysis, 63% of AR job postings specifically require accounting software proficiency, and proficiency in Microsoft Excel appears in virtually every listing.

List your AR software experience prominently: QuickBooks, SAP, Oracle NetSuite, Microsoft Dynamics, Sage, or whatever systems you’ve used. Don’t just list them. If space allows, note your proficiency level or specific modules you’ve mastered.

Excel skills deserve their own callout. “Advanced Excel” isn’t enough. Specify: “Advanced Excel including Pivot Tables, VLOOKUP, macros, and financial modeling.” This specificity helps you pass ATS filters and shows hiring managers you can handle complex data analysis.

Your skills section should also include core AR competencies like invoice processing, payment posting, collections management, account reconciliation, credit analysis, and aging report generation. These keywords align with what ATS systems scan for in AR positions.

Interview Guys Tip: Match your skills section to the job description, but only include skills you actually possess. During interviews, you’ll need to discuss these capabilities using the SOAR Method to prove your expertise.

Education and Certification Requirements

Most AR positions require a minimum of an associate degree in accounting, finance, or business administration. Some employers prefer bachelor’s degrees, but practical experience often outweighs education for AR roles. If you’re entry-level, include relevant coursework like Financial Accounting, Accounts Receivable Management, or Business Mathematics.

Certifications significantly boost your resume’s impact. The Certified Accounts Receivable Professional (CARP) credential demonstrates specialized AR knowledge. QuickBooks ProAdvisor certification proves software mastery. If you’re pursuing a CPA, include “CPA Candidate” to show career ambition.

List education with the degree name, institution, location, and graduation date. If you graduated more than 10 years ago, you can omit the graduation date. Recent graduates should include GPA if it’s 3.5 or higher.

For career changers, emphasize transferable skills from your previous roles that apply to AR work, like data analysis, customer service, or financial record-keeping.

Common Mistakes to Avoid

The biggest mistake is writing generic job descriptions instead of achievement statements. “Responsible for accounts receivable” tells hiring managers nothing. “Managed AR operations reducing bad debt by 30%” tells them everything.

Another critical error is poor formatting that breaks ATS systems. Avoid tables, text boxes, headers, footers, or multiple columns. These design elements look nice but cause ATS software to misread your information. Stick to simple, clean formatting with standard fonts like Calibri or Arial.

Don’t list outdated software like DOS-based accounting programs unless the job specifically requests them. Technology evolves rapidly in accounting. Focus on current systems that most organizations use in 2025.

Many candidates make the mistake of not tailoring their resume for each application. Generic resumes get rejected. Take 10 minutes to adjust your skills and achievements to match the specific job posting’s language.

ATS Optimization and Keywords

Understanding how ATS works is crucial for AR candidates. These systems parse your resume into categories (contact info, work history, education, skills) and then score it based on keyword matches with the job description.

The solution isn’t keyword stuffing. It’s strategic keyword placement. If the job posting says “invoice processing,” use that exact phrase rather than “billing management.” If they want “QuickBooks experience,” don’t write “QB” or “accounting software.”

Research shows that only 25% of resumes make it past ATS filtering. The good news? Most rejections happen because of poor content, not because ATS systems are mysteriously deleting good resumes. Write a strong, keyword-rich resume that addresses the job requirements, and you’ll pass ATS screening.

Focus on including industry-specific terms: accounts receivable, aging reports, collections, invoicing, payment reconciliation, credit analysis, cash application, dunning procedures, and DSO metrics. These terms appear consistently in AR job descriptions and help your resume rank higher in ATS systems.

Want to dive deeper into beating ATS myths? Read our comprehensive guide on the ATS resume rejection myth to understand what really happens to your application.

Interview Guys Tip: Before you submit another application, run your resume through an ATS scanner. Most job seekers skip this step and wonder why they never hear back. Check out the free ATS checker we use and recommend →

Highlighting Customer Service Skills

AR specialists spend significant time interacting with customers about sensitive financial matters. Your resume should demonstrate diplomatic communication abilities alongside technical skills.

Include examples like: “Resolved 95% of billing inquiries on first contact through active listening and problem-solving” or “Maintained positive relationships with 200+ clients while enforcing payment terms and collection policies.”

Customer service achievements show you can balance the company’s need to collect payments with maintaining valuable customer relationships. This skill set is increasingly important as research shows that AR roles are evolving beyond purely transactional tasks toward more strategic relationship management.

FAQ: Accounts Receivable Resume Questions

Q: How long should my accounts receivable resume be? Your AR resume should be one page if you have less than 10 years of experience. With 10+ years or extensive certifications, a two-page resume is acceptable. Focus on recent, relevant experience rather than padding length.

Q: Should I include references on my AR resume? No. References belong on a separate document. The phrase “references available upon request” is outdated and wastes valuable space. Hiring managers will request references when needed.

Q: What if I don’t have direct AR experience? Highlight transferable skills from customer service, data entry, bookkeeping, or administrative roles. Emphasize attention to detail, Excel proficiency, and any financial record-keeping experience. Consider getting QuickBooks certification to strengthen your application.

Q: How do I explain employment gaps on my AR resume? Be honest and brief. Include a one-line explanation in your work history like “Career break for family care” or “Professional development and skill enhancement.” Then focus the interview conversation on what you learned during the gap and why you’re ready to return.

Q: Should my resume match my LinkedIn profile exactly? Your core information should be consistent, but your resume should be more tailored and achievement-focused than LinkedIn. LinkedIn allows more personality and context, while your resume needs to be concise and ATS-optimized.

Conclusion

Your accounts receivable resume is your ticket to landing interviews in a competitive job market. By following this guide and using our free templates, you’re already ahead of most candidates who submit generic, poorly formatted resumes.

Remember these key strategies: quantify every achievement with metrics, optimize for ATS with relevant keywords, showcase both technical and soft skills, and tailor each application to the specific job requirements. The difference between a resume that gets ignored and one that generates interviews often comes down to these details.

Download both templates (the example for inspiration and the blank version for customization), then spend time crafting achievement statements that prove your value. When you land that interview, prepare using our guide on accounts receivable interview questions and answers to seal the deal.

Looking for more resume resources? Browse our complete free resume template library for templates across different industries and career levels.

Not sure if your resume will pass the ATS?

You could have the perfect experience and still get filtered out by automated screening software. The good news? You can test your resume before you apply. Click the button to check out the ATS checker we use and recommend…

BY THE INTERVIEW GUYS (JEFF GILLIS & MIKE SIMPSON)

Mike Simpson: The authoritative voice on job interviews and careers, providing practical advice to job seekers around the world for over 12 years.

Jeff Gillis: The technical expert behind The Interview Guys, developing innovative tools and conducting deep research on hiring trends and the job market as a whole.