Free Financial Advisor Resume Template: + ATS Examples & Writing Guide (2025)

Landing a financial advisor role means more than just having the right certifications. You need a resume that immediately communicates your value, showcases your track record with real numbers, and passes through the Applicant Tracking Systems that 98% of Fortune 500 companies rely on.

The challenge? Most financial advisor resumes look exactly the same. They list duties instead of achievements, bury important certifications, and fail to demonstrate the one thing that matters most: your ability to grow and protect client assets.

By the end of this article, you’ll have access to professional financial advisor resume templates in both completed example and blank formats, plus a complete guide on how to tailor every section for maximum impact. We’ll show you exactly what hiring managers at major financial firms look for and how to position yourself as the advisor they can’t afford to pass up.

☑️ Key Takeaways

- Quantifying your portfolio management with specific dollar amounts and client numbers makes you stand out to hiring managers looking for proven track records

- CFP® and Series 7/66 certifications should be prominently featured in both your summary and certifications section, as these are non-negotiable for most advisory roles

- ATS optimization requires using industry-specific keywords like “asset allocation,” “retirement planning,” and “wealth management” throughout your resume

- Your experience section must demonstrate both technical financial expertise and soft skills like client relationship building to show you’re the complete package

What Makes a Financial Advisor Resume Different?

Financial advisor resumes require a unique approach because you’re marketing both your technical expertise and your ability to build lasting client relationships. Unlike purely analytical finance roles, your resume must prove you can explain complex concepts to non-financial audiences while delivering measurable portfolio growth.

The best financial advisor resumes share three critical elements. First, they lead with credentials like CFP®, CFA, or Series licenses because these immediately establish credibility. Second, they quantify everything with specific dollar amounts, percentage growth rates, and client retention numbers. Third, they demonstrate a balance between technical skills and interpersonal abilities that clients value.

Interview Guys Tip: Your resume is essentially a performance report on your most important client: yourself. If you wouldn’t present vague claims without data to a client, don’t do it on your resume either.

According to the Bureau of Labor Statistics, employment of financial advisors is projected to grow 17% from 2023 to 2033, much faster than the average for all occupations. This rapid growth means competition for top positions at established firms is fierce, making a standout resume absolutely essential.

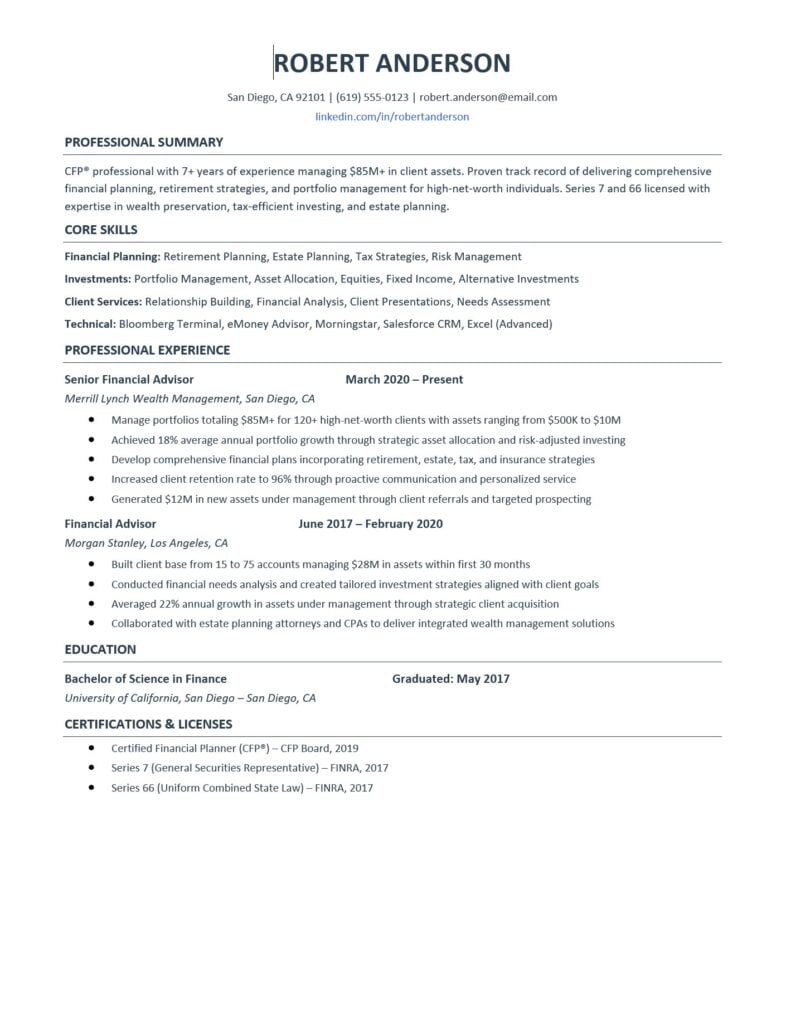

Financial Advisor Resume Example

Here’s a resume example. This example gives you an idea of what type of content fits in a good ATS friendly resume.

Example Resume:

Here’s a professional financial advisor template you can download and customize. This template is designed to be both visually appealing and ATS-friendly, with clean formatting that highlights your strengths.

Blank Customizable Template

Download Your Free Template:

- Download DOCX Template (fully editable in Microsoft Word)

Interview Guys Tip: The DOCX template is fully editable, allowing you to adjust fonts, colors, and spacing to match your personal brand while maintaining professional formatting. Just replace the placeholder text with your own information.

Over 75% of resumes get rejected by ATS software before a human ever sees them…

The good news? You can test your resume before you apply. Want to know where you stand? Test your resume with our recommended ATS scanner →

Essential Components of a Financial Advisor Resume

Your financial advisor resume needs six core sections, arranged in an order that leads with your strongest selling points.

- Professional Summary comes first and should pack your most impressive credentials into 3-4 sentences. This is where you mention your certifications, years of experience, assets under management, and specialized expertise.

- Core Skills follows immediately after, organized into categories like Financial Planning, Investments, Client Services, and Technical proficiencies. This section helps you pass ATS scans while giving human readers a quick snapshot of your capabilities.

- Professional Experience takes up the most real estate and should demonstrate progressive responsibility. Each role needs quantified achievements that show portfolio growth, client acquisition, and retention success.

- Education typically includes your bachelor’s degree in finance, economics, or related fields. Recent graduates can expand this section with relevant coursework, while experienced advisors keep it brief.

- Certifications & Licenses is non-negotiable for financial advisors. This section should list your CFP®, CFA, Series 7, Series 66, or other relevant credentials with the issuing organization and year obtained.

- Optional Sections like Professional Affiliations, Publications, or Speaking Engagements can differentiate you for senior-level positions, but only include them if they add genuine value.

How to Write Each Resume Section

Crafting Your Professional Summary

Your summary needs to answer three questions immediately: What certifications do you hold? How much money do you manage? What results have you delivered?

Start with your most impressive credential followed by years of experience. Then quantify your assets under management and client base. Finish with your specialized focus or standout achievement.

- Weak example: “Experienced financial advisor seeking to help clients achieve their financial goals through comprehensive planning and investment management.”

- Strong example: “CFP® professional with 7+ years managing $85M+ in client assets. Proven track record delivering 18% average portfolio growth for high-net-worth individuals through strategic asset allocation and risk management. Series 7 and 66 licensed with expertise in retirement planning and estate strategies.”

The strong version immediately establishes credibility with the CFP® designation, quantifies scale with the $85M figure, demonstrates results with the 18% growth rate, and signals specialization with high-net-worth clients.

Building Your Core Skills Section

Organize your skills into categories that mirror how financial advisory work actually flows. This makes your resume scannable while ensuring you hit the keywords ATS systems search for.

- Financial Planning Skills should include retirement planning, estate planning, tax strategies, risk management, and insurance planning. These demonstrate your ability to handle comprehensive client needs.

- Investment Skills cover portfolio management, asset allocation, equities, fixed income, alternative investments, and rebalancing strategies. This shows your technical investment expertise.

- Client Service Skills highlight relationship building, needs assessment, client presentations, financial analysis, and communication abilities. These prove you’re not just a numbers person.

- Technical Proficiencies list the software and platforms you use daily: eMoney Advisor, Morningstar, Bloomberg Terminal, Salesforce CRM, and advanced Excel skills. Many firms search specifically for experience with their preferred platforms.

Showcasing Your Professional Experience

This section makes or breaks your resume. Every bullet point should follow a simple formula: action verb + specific task + quantified result.

Interview Guys Tip: When describing client portfolios, always include both the total assets under management AND the number of clients. Managing $50M for 5 clients is very different from managing $50M for 100 clients, and hiring managers know this distinction matters.

Start each bullet with strong action verbs like “managed,” “achieved,” “increased,” “developed,” or “generated.” Then quantify everything possible. How much money did you manage? How many clients? What was your retention rate? What returns did you generate?

- Instead of: “Responsible for managing client portfolios and providing financial advice.”

- Write: “Managed portfolios totaling $85M for 120+ high-net-worth clients, achieving 18% average annual growth through strategic asset allocation.”

For newer advisors without massive AUM numbers, focus on growth metrics: “Built client base from 15 to 75 accounts within 30 months, averaging 22% annual growth in assets under management.”

Check out our guide on how to prepare for a financial advisor interview once your resume starts generating callbacks.

Presenting Your Education

For experienced financial advisors, keep education brief. List your degree, major, university, and graduation year on 2-3 lines. If you graduated more than 10 years ago, you can omit the year.

Recent graduates should expand this section slightly by including relevant coursework like Investments, Financial Planning, Portfolio Management, or Corporate Finance. A GPA above 3.5 can also be included, but omit it if lower.

If you have an MBA or master’s degree in finance, list that above your bachelor’s degree since higher education always comes first.

Highlighting Certifications & Licenses

This section deserves prominent placement because certifications are often deal-breakers in financial advisory. The most valuable credentials are:

- CFP® (Certified Financial Planner) is the gold standard for comprehensive financial planning. It requires education, examination, experience, and ethics components, making it highly respected by clients and employers.

- Series 7 (General Securities Representative) and Series 66 (Uniform Combined State Law) are the most common FINRA licenses for financial advisors. These allow you to sell securities and provide investment advice.

- CFA® (Chartered Financial Analyst) brings exceptional credibility for investment-focused advisory roles, though it requires significantly more time investment than a CFP®.

- ChFC (Chartered Financial Consultant) is an alternative to CFP® that covers similar ground with different requirements.

List each certification with the full name, issuing organization, and year obtained. Use the proper designation format (CFP®, CFA®, etc.) exactly as the certifying body requires.

Common Mistakes to Avoid

The biggest mistake financial advisors make is listing job duties instead of achievements. Writing “responsible for client portfolio management” tells employers nothing about your actual performance. Instead, quantify your impact with specific numbers.

Another critical error is burying your certifications. Your CFP® or CFA should appear in your summary, not just in a certifications section employers might not reach. These credentials open doors and should be front and center.

Many advisors also make the mistake of using generic language that could apply to any financial role. Avoid phrases like “team player” or “excellent communication skills” without context. Instead, demonstrate these qualities through specific achievements: “Increased client retention to 96% through proactive communication and quarterly portfolio reviews.”

Don’t list outdated technology skills or irrelevant early career jobs. Focus your resume summary on the last 10-15 years of relevant experience, unless earlier roles directly relate to financial advisory.

Finally, never include your photo, age, marital status, or other personal information. These details risk introducing bias and have no place on modern resumes. Stick to professional qualifications that demonstrate your ability to excel in the role.

ATS Optimization and Keywords

Applicant Tracking Systems scan your resume for specific keywords before human eyes ever see it. Understanding how to optimize for ATS while maintaining readability is crucial for financial advisors.

Critical Keywords for financial advisor resumes include: portfolio management, asset allocation, financial planning, wealth management, retirement planning, estate planning, risk management, client relationship management, investment strategies, and compliance.

Certification keywords like CFP®, CFA®, Series 7, Series 66, and licensed financial advisor should appear multiple times throughout your resume. Don’t just list them once in a certifications section.

Use standard section headings like “Professional Experience” instead of creative alternatives like “Career Journey.” ATS systems look for conventional formatting and may miss information under non-standard headers.

Interview Guys Tip: The job description is your ATS keyword goldmine. If a posting mentions “comprehensive financial planning” three times, make sure that exact phrase appears in your resume (assuming it accurately describes your experience).

Keep formatting simple with standard fonts like Calibri or Arial in 10-12 point size. Avoid tables, text boxes, headers, footers, and graphics that ATS systems might not parse correctly. Our free ATS-friendly resume template is designed to pass these systems with flying colors.

Spell out acronyms at least once alongside the abbreviated version. Write “Certified Financial Planner (CFP®)” on first reference, then “CFP®” in subsequent mentions. This ensures ATS systems catch both variations.

Interview Guys Tip: Before you submit another application, run your resume through an ATS scanner. Most job seekers skip this step and wonder why they never hear back. Check out the free ATS checker we use and recommend →

Tailoring Your Resume for Different Advisory Roles

Not all financial advisor positions are created equal. Wealth management roles at major firms require different emphasis than independent RIA positions or bank-based advisory roles.

- For Wealth Management Firms like Merrill Lynch or Morgan Stanley, emphasize your experience with high-net-worth clients, sophisticated investment strategies, and your ability to work within a team structure. These firms value advisors who can cross-sell services and leverage in-house resources.

- For Independent RIAs, highlight your entrepreneurial skills, business development achievements, and self-sufficiency. Show evidence of building your own client base, managing all aspects of client relationships, and driving revenue growth.

- For Bank-Based Advisory Roles, focus on your ability to convert banking customers into advisory clients, cross-sell financial products, and work within compliance frameworks. Banks want advisors who excel at warm lead conversion.

- For Entry-Level Positions, shift focus to your education, recent certifications, and transferable skills. Emphasize your willingness to learn and any internship or training program experience you’ve completed.

Adjust your professional summary and achievement bullets to match each role’s specific requirements. This targeted approach significantly increases your interview callback rate.

Frequently Asked Questions

Should I include my AUM (Assets Under Management) on my resume?

Absolutely yes. Your AUM is one of the most important metrics for financial advisor roles and should appear prominently in your professional summary and experience bullets. Always pair it with client count for context.

How many years of experience should I include?

Focus on the last 10-15 years of relevant experience. Earlier roles can be summarized in a single line if they’re not directly related to financial advisory. Recent graduates should expand education and certifications sections to compensate for limited experience.

Do I need different resumes for CFP® and non-CFP® positions?

Yes, your resume should emphasize different strengths based on role requirements. CFP®-focused positions need heavy emphasis on comprehensive planning, while investment-focused roles should highlight portfolio management and returns. Always tailor to the specific job description.

Should my resume be one page or two pages?

Experienced financial advisors with 5+ years should use two pages to adequately showcase their achievements, certifications, and client results. Entry-level advisors or recent graduates should keep it to one page. Never exceed two pages regardless of experience level.

How do I show client relationship skills without breaching confidentiality?

Use aggregate data and percentages rather than specific client names or details. Write “Maintained 96% client retention rate through proactive communication” instead of naming clients or sharing specific account information.

Start Building Your Financial Advisor Resume Today

A compelling financial advisor resume opens doors to rewarding career opportunities in a field experiencing exceptional growth. With financial advisor employment projected to increase 17% through 2033, now is an ideal time to position yourself for success.

Use the downloadable templates provided above as your starting point, then customize every section with your specific achievements, certifications, and client results. Remember that your resume isn’t just a career history but a persuasive document proving you can deliver results for both clients and employers.

Focus on quantifiable achievements that demonstrate your value, optimize for ATS systems with industry-specific keywords, and ensure your certifications are prominently displayed. The difference between a good resume and a great one often comes down to specific numbers and concrete evidence of your capabilities.

Ready to explore more career resources? Browse our complete free resume template library for additional formats and industry-specific guides.

Not sure if your resume will pass the ATS?

You could have the perfect experience and still get filtered out by automated screening software. The good news? You can test your resume before you apply. Click the button to check out the ATS checker we use and recommend…

BY THE INTERVIEW GUYS (JEFF GILLIS & MIKE SIMPSON)

Mike Simpson: The authoritative voice on job interviews and careers, providing practical advice to job seekers around the world for over 12 years.

Jeff Gillis: The technical expert behind The Interview Guys, developing innovative tools and conducting deep research on hiring trends and the job market as a whole.