Investment Banking Resume Template: ATS Examples & Writing Guide [2025]

Landing an investment banking role is one of the most competitive challenges in finance. With acceptance rates at top firms like Goldman Sachs falling to 0.8% and some banks receiving over 360,000 applications for just 2,600 positions, your resume needs to be absolutely flawless.

The difference between landing interviews at J.P. Morgan or getting lost in the application black hole often comes down to how effectively you present your qualifications. Investment banking resumes require a specific approach that showcases transaction experience, quantifies your impact, and demonstrates the technical prowess that banks demand.

In this guide, you’ll learn exactly how to structure an investment banking resume that passes ATS screening and impresses hiring managers. We’ll cover the essential components, common mistakes that sink applications, and proven strategies used by successful analysts at bulge bracket firms. By the end of this article, you’ll have a clear roadmap for creating a resume that positions you as a serious candidate worthy of an interview.

☑️ Key Takeaways

- Investment banking resumes must quantify your impact with specific deal values, transaction metrics, and measurable outcomes to stand out in a field with acceptance rates below 1%

- Technical proficiency is non-negotiable: showcase advanced Excel modeling, Bloomberg Terminal expertise, and financial analysis skills that prove you can handle complex valuations from day one

- Education and certifications carry exceptional weight in investment banking, with 91% of job postings requiring finance or business degrees and CFA credentials significantly boosting candidacy

- Keep your resume to exactly one page with reverse-chronological formatting, as hiring managers spend only 6 seconds on initial screening and ATS systems favor clean, structured layouts

What Makes an Investment Banking Resume Different?

Investment banking resumes follow a distinct format that differs significantly from resumes in other industries. The emphasis is on deal experience, quantitative achievements, and technical capabilities rather than soft skills or general responsibilities.

Banks want to see proof that you can handle high-pressure situations, build complex financial models, and contribute to transactions worth hundreds of millions of dollars. Your resume must demonstrate these abilities through specific examples and metrics.

The reverse-chronological format is standard across all banks. This means your most recent and relevant experience appears first, making it easy for recruiters to assess your qualifications quickly. Given that investment banking recruiters spend an average of 6 seconds reviewing each resume initially, clarity and structure are paramount.

Interview Guys Tip: Never include a photo on your investment banking resume unless you’re applying internationally where it’s specifically required. Conservative financial institutions expect a no-frills, content-focused document. Save creative design elements for other industries.

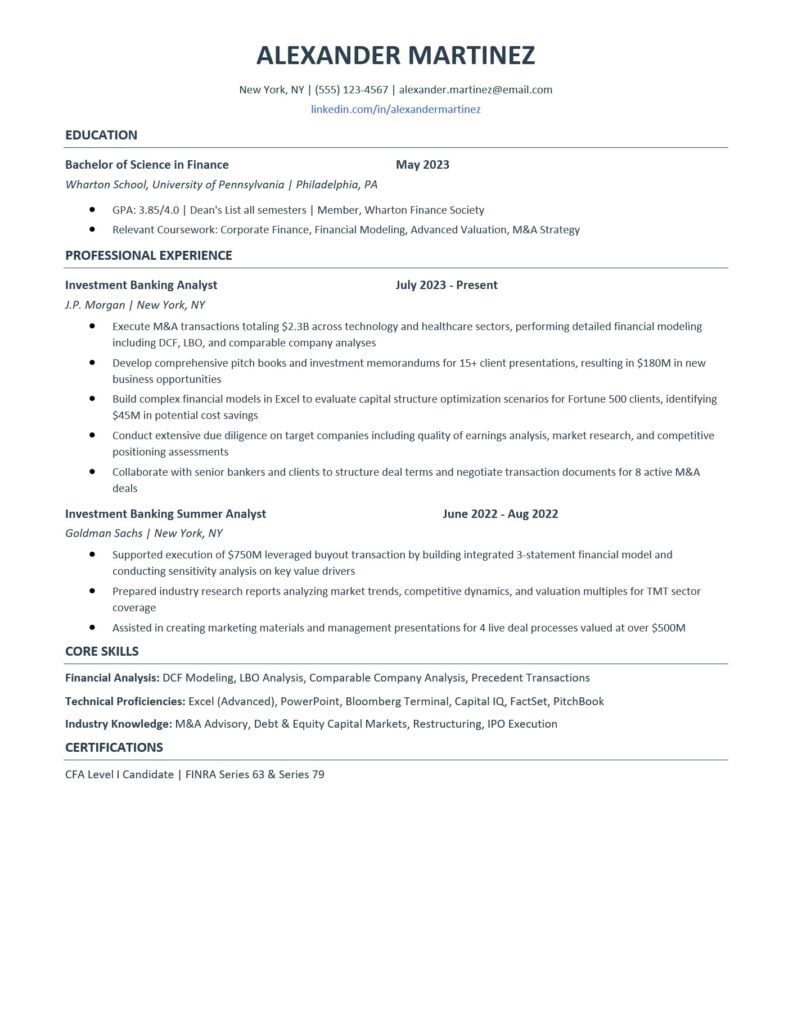

Investment Banking Resume Example

Here’s a professional investment banking resume example. This example gives you an idea of what type of content fits in a good ATS friendly resume.

Example Resume:

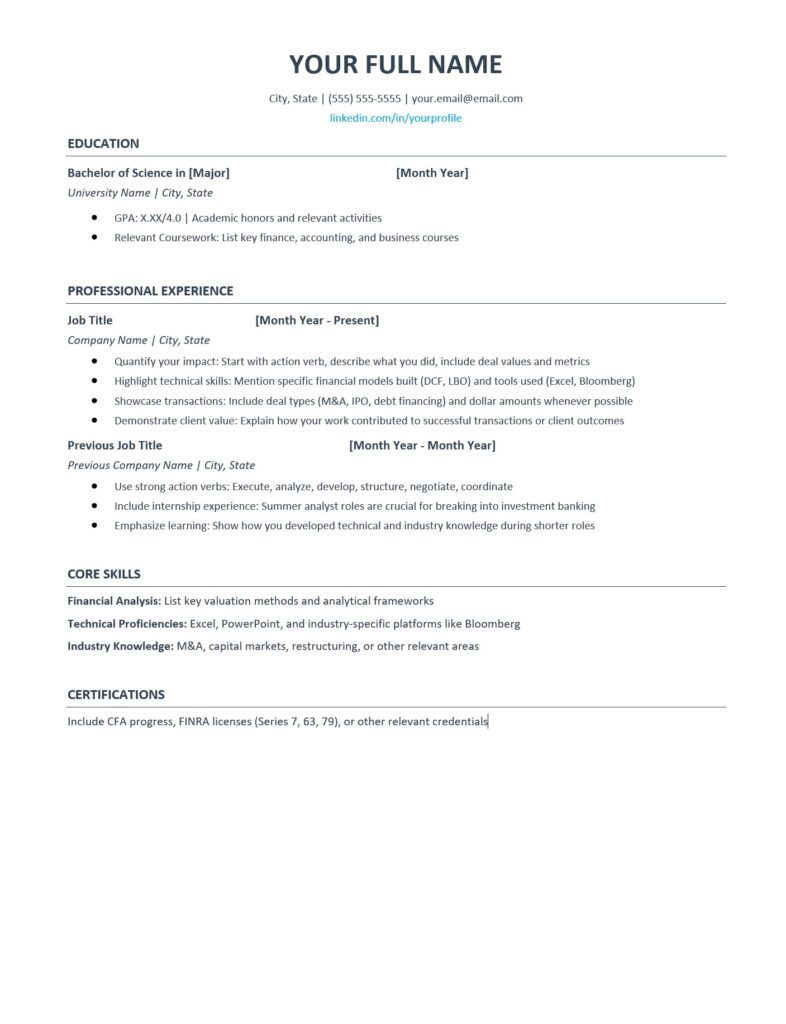

Here’s a professional investment banking resume template you can download and customize. This template is designed to be both visually appealing and ATS-friendly, with clean formatting that highlights your strengths.

Blank Customizable Template

Download Your Free Template:

- Download DOCX Template (fully editable in Microsoft Word)

Interview Guys Tip: The DOCX template is fully editable, allowing you to adjust fonts, colors, and spacing to match your personal brand while maintaining professional formatting. Just replace the placeholder text with your own information.

Over 75% of resumes get rejected by ATS software before a human ever sees them…

The good news? You can test your resume before you apply. Want to know where you stand? Test your resume with our recommended ATS scanner →

Essential Components of a Winning Investment Banking Resume

Contact Information and Header

Your header should be clean, professional, and easy to read. Include your full name in a larger font, followed by your location, phone number, and email address. Add your LinkedIn profile URL as well.

Make sure your email address is professional. Use some variation of your name rather than nicknames or outdated addresses from high school. Your LinkedIn URL should be customized to match your name rather than a random string of numbers.

Education Section Positioning

Education placement depends on your career stage. For recent graduates and current students, lead with education before experience. This signals that you have fresh, relevant knowledge from a target school.

According to research on investment banking job postings, business degrees are required in 91% of positions, with finance degrees specified in 63% of postings. Include your major, university name, graduation date, GPA (if 3.5 or higher), relevant coursework, and academic achievements.

For experienced professionals with multiple years in banking, move education after your work experience. Your deal track record matters more than your diploma at that point.

Professional Experience: The Core of Your Resume

This section makes or breaks your application. Investment banks want to see specific transaction experience with quantifiable results.

Start each bullet point with a strong action verb. Use words like executed, analyzed, developed, structured, negotiated, or coordinated. Then describe what you did and include concrete numbers wherever possible.

Instead of writing “Assisted with M&A transactions,” write “Executed M&A transactions totaling $2.3B across technology and healthcare sectors, performing detailed financial modeling including DCF, LBO, and comparable company analyses.”

Every accomplishment should ideally include three components: what you did, the deal value or metric, and the outcome or impact. This formula proves you understand how to communicate in the language of investment banking.

For each role, include 3-5 bullet points. Focus on the most impressive and relevant experiences. If you worked on a $500M leveraged buyout, that deserves a bullet. Administrative tasks don’t.

Interview Guys Tip: If you’re an entry-level candidate without extensive internship experience, leverage academic projects that demonstrate financial modeling skills. Include any case competitions, student-managed investment funds, or relevant coursework projects where you built valuation models or analyzed companies.

Skills Section Strategy

Your skills section serves two critical purposes: passing ATS screening and quickly showing recruiters you have the technical capabilities required.

Organize skills into clear categories. Financial Analysis might include DCF modeling, LBO analysis, comparable company analysis, and precedent transactions. Technical Proficiencies should list Excel (note if you’re advanced), PowerPoint, Bloomberg Terminal, Capital IQ, FactSet, and PitchBook.

Don’t just list software names. If you’re genuinely advanced in Excel, say so. Banks need analysts who can build complex integrated financial models, not just basic spreadsheets.

According to hiring trends in investment banking for 2025, technical skills remain the top priority. Banks are specifically seeking candidates who can demonstrate proficiency in financial modeling from day one.

Certifications and Additional Credentials

Certifications carry significant weight in investment banking. The CFA designation is highly respected, even at Level I candidate status. FINRA licenses like Series 7, Series 63, Series 66, and Series 79 are valuable credentials that demonstrate your commitment to the industry.

If you’re pursuing your CFA, include your level and expected completion date. For FINRA licenses, list them clearly with the full names rather than just numbers.

How to Write Each Section Effectively

Crafting Your Education Bullets

Beyond listing your degree, use bullet points under your education to showcase academic achievements and relevant activities. Include your GPA if it’s strong, dean’s list recognition, relevant coursework, finance club involvement, and any academic research related to finance or economics.

Relevant coursework should be specific to investment banking. Corporate finance, financial modeling, advanced valuation, M&A strategy, derivatives, and financial statement analysis are all appropriate to mention.

Building Powerful Experience Bullets

The quality of your experience bullets determines whether you get interviews. Each bullet should tell a compelling story about your contribution to actual transactions.

Start with the action. Use powerful verbs that convey responsibility and initiative. Follow with the specific activity you performed, whether it was building financial models, conducting industry research, or preparing pitch materials.

Then add the metrics. Deal values are your best friend here. If you worked on a transaction, include the dollar amount. If you built models, mention how many or what type. If you prepared pitches, note how many client presentations resulted.

Finally, include the outcome when possible. Did your analysis identify cost savings? Did your pitch materials contribute to winning new business? Did your due diligence reveal critical insights that shaped deal structure?

Check out our guide on how to make a resume for more fundamental resume-building strategies that apply across industries.

Optimizing Your Skills Section for ATS

Applicant Tracking Systems scan resumes for specific keywords before human eyes ever see your application. To pass ATS screening, mirror language from the job description in your skills section.

If the posting mentions “financial modeling,” use that exact phrase rather than “building models.” If they want “M&A advisory experience,” include those specific words. Read job descriptions carefully and incorporate the technical terms banks use.

However, only include skills you actually possess. Banks will test your technical knowledge during interviews, and claiming expertise you don’t have will end your candidacy immediately.

Common Investment Banking Resume Mistakes to Avoid

Generic Descriptions Without Metrics

The biggest mistake is describing responsibilities rather than accomplishments. Banks don’t care that you “assisted senior bankers with various projects.” They want to know you “supported execution of $750M leveraged buyout transaction by building integrated 3-statement financial model.”

Numbers matter in investment banking. Every metric you can quantify should be quantified. Deal values, number of transactions, percentage improvements, dollar amounts of cost savings, and project counts all belong on your resume.

Exceeding One Page

Investment banking resumes should be exactly one page unless you’re at the VP level or higher with extensive transaction history. Analysts and associates must fit their experience on a single page.

This constraint forces you to be selective and strategic. Include only your most impressive and relevant experiences. Cut anything that doesn’t directly support your candidacy for investment banking roles.

Using Fancy Formatting or Photos

Conservative financial institutions expect traditional, clean resume formatting. Stick to classic fonts like Calibri, Arial, or Times New Roman in 10-12 point size. Use a single-column layout with clear section headers.

Avoid graphics, charts, tables, columns, text boxes, or photos. These elements often confuse ATS systems and can prevent your resume from being properly scanned. In banking, content matters infinitely more than creative design.

Listing Irrelevant Experience

That high school lemonade stand doesn’t belong on your investment banking resume. Limit your work experience to the most relevant and recent two to four roles.

For students and recent graduates, include relevant internships, part-time roles in finance, and significant leadership positions. For experienced professionals, focus exclusively on roles that demonstrate financial acumen and deal experience.

Interview Guys Tip: Many candidates worry about brief internships or short-term roles appearing problematic. In investment banking, summer analyst programs are the norm and are expected to be 8-10 weeks long. These don’t raise red flags. Just be prepared to discuss what you learned and accomplished during that timeframe.

ATS Optimization and Keywords for Investment Banking

Understanding how ATS systems work helps you optimize your resume for maximum visibility. These systems scan documents for specific keywords and phrases that match job requirements.

Investment banking keywords typically include position titles (analyst, associate, vice president), transaction types (M&A, IPO, debt financing, restructuring), technical skills (financial modeling, DCF, LBO, comparable company analysis), and industry terms (pitch book, due diligence, valuation multiples).

Review multiple job postings for positions you’re targeting. Note which terms appear repeatedly. These are the keywords you should naturally incorporate throughout your resume, particularly in your skills and experience sections.

However, avoid keyword stuffing or including skills you don’t possess just to pass ATS screening. Your resume must still read naturally when human recruiters review it. The goal is strategic keyword placement, not gaming the system.

For more guidance on ATS optimization strategies, read our article on resume keywords by industry.

Interview Guys Tip: Before you submit another application, run your resume through an ATS scanner. Most job seekers skip this step and wonder why they never hear back. Check out the free ATS checker we use and recommend →

Tailoring Your Resume for Different Banking Roles

Analyst Positions

Entry-level analyst positions emphasize educational credentials, internship experience, and technical skill proficiency. Highlight your academic achievements, relevant coursework, and any summer analyst roles or finance internships.

For analyst applications, emphasize your ability to build financial models, conduct research, and support senior bankers. Include academic projects where you performed valuation analyses or created investment theses.

Associate and VP Levels

Mid-level positions require proven deal execution experience. Your resume should demonstrate increasing responsibility, client interaction, and deal leadership.

Associates typically need an MBA or several years of analyst experience. Emphasize larger transaction values, more complex deal structures, and instances where you managed relationships with clients or mentored junior team members.

For VP roles, showcase your ability to source deals, manage multiple transactions simultaneously, and generate revenue for the firm.

FAQ: Investment Banking Resume Questions

How long should an investment banking resume be?

Exactly one page for analyst and associate positions. Only managing directors and more senior professionals with extensive transaction histories should consider two-page resumes. Banks receive hundreds of applications and spending time on long resumes isn’t realistic.

Should I include my GPA on my investment banking resume?

Yes, if it’s 3.5 or higher. Investment banks are highly competitive and academic performance signals intellectual capability. If your overall GPA is lower but your major GPA is strong, you can list your major GPA instead.

What’s the most important section of an investment banking resume?

Professional experience is paramount, particularly for experienced candidates. For recent graduates, education matters most since you likely have limited work history. Both sections must be strong, but experience with actual transaction work carries the most weight.

Do I need finance-related internships to get an investment banking job?

While finance internships significantly strengthen your candidacy, they’re not absolutely required for breaking in. Many successful analysts come from consulting, corporate finance, or even unrelated fields if they can demonstrate strong quantitative skills and genuine interest in investment banking. The best way to email a recruiter can help you network effectively even without perfect credentials.

Should I customize my investment banking resume for each application?

Absolutely. Review each job description and adjust your keywords, skills, and experience descriptions to align with specific requirements. This doesn’t mean rewriting your entire resume, but strategic tweaks to emphasize relevant experience can significantly improve your chances.

Your Next Steps to Landing Investment Banking Interviews

Creating a powerful investment banking resume is your first step toward breaking into this competitive industry. Focus on quantifying your achievements, highlighting technical proficiency, and presenting information in a clear, scannable format that both ATS systems and human recruiters can quickly process.

Remember that only about 10% of aspiring investment bankers with college degrees successfully land positions in the field. Your resume needs to demonstrate why you belong in that elite group.

Download the templates provided in this guide and customize them with your specific experience, education, and achievements. Pay attention to every detail, from contact information to bullet point structure. In an industry where precision matters, even small resume errors can eliminate you from consideration.

For more resume resources across different industries and career levels, browse our free resume template library to find additional formats and examples.

Not sure if your resume will pass the ATS?

You could have the perfect experience and still get filtered out by automated screening software. The good news? You can test your resume before you apply. Click the button to check out the ATS checker we use and recommend…

BY THE INTERVIEW GUYS (JEFF GILLIS & MIKE SIMPSON)

Mike Simpson: The authoritative voice on job interviews and careers, providing practical advice to job seekers around the world for over 12 years.

Jeff Gillis: The technical expert behind The Interview Guys, developing innovative tools and conducting deep research on hiring trends and the job market as a whole.