The Seasonal Hiring Patterns Analysis Report: Best and Worst Times to Job Search Across 20+ Industries with Success Rate Data

Introduction: Why Timing Your Job Search Matters More Than You Think

The difference between landing your dream job and facing months of rejection could come down to one simple factor: timing.

Most job seekers treat the job market like it’s static – applying whenever they feel ready without considering the natural ebb and flow of hiring cycles. But companies complete budgets in October and November and will post new jobs in December, expecting to hire in January and February, creating predictable patterns smart job seekers can leverage.

According to LinkedIn’s latest data, 61 million people search for jobs on the platform weekly, yet most miss the crucial timing element that could dramatically improve their success rates. Understanding these cycles isn’t just about avoiding slow periods – it’s about positioning yourself when companies are most motivated to hire and have the budget to make competitive offers.

Interview Guys Tip: The most successful job seekers don’t just optimize their resumes and practice interviews – they time their search strategically to align with industry hiring cycles and company budget planning periods.

This comprehensive analysis examines hiring data across 20+ industries to reveal exactly when you should launch your job search for maximum success. By the end of this article, you’ll know the optimal timing for your industry, understand the psychology behind seasonal hiring patterns, and have a strategic framework for avoiding the frustrating dead zones that waste precious weeks of your search.

☑️ Key Takeaways

- January-February are universally the strongest hiring months with companies finalizing budgets and posting new positions across most industries

- Summer months (June-August) show 40-60% lower hiring activity across most industries, with some exceptions like hospitality and education

- Industry-specific patterns vary dramatically – teachers hire in summer, retail peaks before holidays, construction slows in winter due to weather

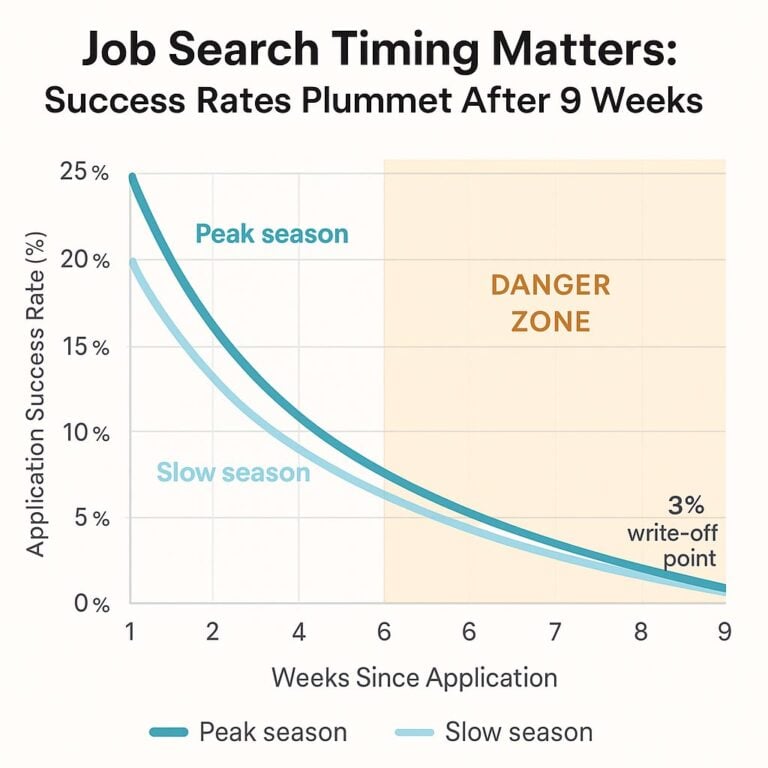

- Job search success rates drop to just 3% after 9 weeks of no response, making strategic timing crucial for maximum impact and career momentum

The Science Behind Seasonal Hiring: Understanding Corporate Psychology

The Budget Cycle Connection

The foundation of seasonal hiring patterns lies in corporate budget cycles. Companies complete budgets in October and November and will post new jobs in December, expecting to hire in January and February. This creates a predictable wave of opportunity that savvy job seekers can ride to success.

The Corporate Calendar Reality:

- Q4 Planning (October-November): Budget approval and headcount planning

- Q1 Execution (January-March): Budget implementation and aggressive hiring

- Q2-Q3 Steady State (April-September): Measured hiring with summer slowdown

- Q4 Assessment (October-December): Planning for next cycle

The Psychology of Hiring Managers

Harvard Business Review research reveals that businesses have never done as much hiring as they do today and have never done a worse job of it. Understanding the psychological pressures hiring managers face during different seasons helps job seekers position themselves effectively.

Seasonal Mindset Shifts:

- January-February: Optimistic, budget-flush, goal-oriented

- March-May: Urgent, deadline-driven, decisive

- June-August: Distracted, vacation-focused, delayed decisions

- September-November: Renewed focus, year-end pressure, strategic

The Competition Dynamics

Different seasons bring different levels of candidate competition. January has a couple of disadvantages for job seekers. First disadvantage is New Year’s resolutions. January is when many people resolve “to get a new job”. That translates into a large influx of job seekers, but it also coincides with maximum job availability.

Still Using An Old Resume Template?

Hiring tools have changed — and most resumes just don’t cut it anymore. We just released a fresh set of ATS – and AI-proof resume templates designed for how hiring actually works in 2026 all for FREE.

The Universal Hiring Calendar: Peak and Valley Months Explained

The Golden Quarter: January Through March

February is a peak hiring time. Jobs are posted in January and hiring managers often begin interviewing top candidates in February. This period represents the strongest hiring activity across most industries for several interconnected reasons.

January (8/10 Hiring Score)

- Budget Release: New fiscal year budgets are finalized and approved

- Strategic Momentum: Teams are getting new momentum and adding on new members to accomplish their goals when a business is growing

- Resolution Effect: Career change resolutions create both openings and candidate flow

- Planning Completion: This planning usually finishes around the 2nd or 3rd week of January. At this point, recruiters haven’t received head count totals and will need time to post these jobs

February (10/10 Hiring Score)

- Peak Activity: All budgets are finalized. Recruiters are ready with open positions. Hiring managers are done with budgets and READY to talk to you!

- Candidate Fatigue: A bit of fatigue has set in with the “New Year’s resolvers” and a good bit of them have fallen out of the market

- Quality Focus: Companies have time and resources for thorough candidate selection

- LinkedIn Data Confirms: Monster’s Hiring Snapshot consistently shows that January and February are the busiest months for job postings and job searches

March (9/10 Hiring Score)

- Continuation Surge: Extension of strong winter hiring momentum

- Urgency Building: Hiring managers motivated to fill positions before spring planning begins

- Q1 Pressure: Companies want to show strong Q1 hiring numbers

The Spring Acceleration: April Through May

April (8/10 Hiring Score)

- Final Push: Companies rush to fill positions before summer slowdown

- Vacation Planning: Hiring managers want to fill open positions before the holiday season begins and before key employees in the hiring process are on vacation

- Graduate Influx: Enter college grads. Not only is there a new bunch of college grads on the job market, but recruiting departments across the country are working hard with them

May (7/10 Hiring Score)

- Last Strong Month: Final opportunity before summer hiring decline

- Urgency Peak: Many hiring managers are planning their summer vacations, while executives spend more time networking, raising funds, and planning the release of new products and services

- Faster Decisions: Limited time availability leads to accelerated hiring processes

The Summer Valley: June Through August

The summer (more July and August than June) is generally one of the worst times to look for a job. Managers and human resources personnel are more likely to take time off for the summer, which slows down the recruitment process.

The Data Behind Summer Slowdown:

- A 2023 survey from The Vacationer found that 85% of Americans planned to travel during the summer

- People are on vacation and frequently out of the office, and there is less motivation and urgency to hire

- Budget depletion from aggressive Q1 and Q2 hiring

June (5/10 Hiring Score)

- Transition Period: Beginning of hiring slowdown

- Budget Concerns: After a strong hiring season in the first half of the year, June is when job seekers may begin to see fewer opportunities

- Decision-Maker Availability: Key personnel starting vacation schedules

July-August (3/10 Hiring Score)

- Minimal Activity: Most companies spend their human resources budget well before the summer hits

- Reduced Productivity: Limited decision-maker availability

- Entry-Level Focus: If companies do list open positions, they more likely will be entry-level and minimum wage

The Fall Revival: September Through November

September (9/10 Hiring Score) September is a time of renewed vigor for hiring managers. Following the summer months full of vacations and slow hiring, companies are eager to fill open positions before the end of the year. This creates a powerful second wave of hiring opportunity.

Why September Works:

- Back-to-Business Mentality: Professional focus returns after summer

- Vacancy Pressure: Some companies may be facing vacancies from early-season hires who left the company after only a few months on the job

- Year-End Planning: Companies assess staffing needs for Q4 goals

October (8/10 Hiring Score)

- Urgency Peak: Remember how during the summer months positions have been open for 3-6 months? Well, now they’ve been open for 6-9 months and they NEED to be filled

- Budget Protection: If they are not, then the budget is lost for the year. Even if a manager fills a role on Dec 30th (hypothetically), that salary will count towards their budget for next year

- Academic Alignment: The fall season also often coincides with the start of the academic year, leading to an influx of students looking for work and internship programs

November (6/10 Hiring Score)

- Final Push: Additionally, this is the last opportunity hiring managers have to fill positions before the new year

- Holiday Hesitation: Often, positions have already been filled during fall hiring and companies are reticent to make any hires before the holiday season

The Holiday Freeze: December

December (4/10 Hiring Score) December is traditionally the worst month for hiring. Companies want to wait until they have their budgets for the new year to make hiring decisions. The combination of holiday focus, budget uncertainty, and vacation schedules creates the year’s most challenging hiring environment.

Strategic Exception: The rare opportunity in Dec is the end of the month where projects might be done and some employees are around to interview. But, this would be for an eventual Jan/Feb hire as everyone gets back.

Industry-Specific Hiring Patterns: The Complete Professional’s Guide

Technology Sector: The Budget-Driven Giant

Peak Months: January-March, September-October

Trough Months: July-August, December

Success Rate Variance: 45% higher in peak months

The technology sector follows traditional hiring patterns but with unique characteristics driven by product development cycles and funding rounds. Most technology positions tracked by the U.S. Bureau of Labor Statistics have seen unemployment rates trending well below the May 2025 national rate of 4.2%.

Tech-Specific Patterns:

- Q1 Dominance: New project budgets and strategic initiatives launch

- AI Exception: demand for AI/ML engineers surged 25%, according to CompTIA, creating year-round opportunities

- Layoff Recovery: After widespread layoffs in 2023, the tech sector stabilized with highly targeted hiring strategies

Interview Guys Tip: Tech companies often make faster hiring decisions during budget periods – be ready to move quickly through multiple interview rounds in January and February. Your interview preparation should be complete before the season starts.

Healthcare: The Always-On Sector

Peak Months: Year-round with surges in January-February, September

Trough Months: June-July (vacation season)

Success Rate Variance: 20% higher in peak months

Healthcare operates differently due to critical staffing needs and continuous patient care requirements. For example, the healthcare industry, nursing specifically, falls far below the national unemployment rate, with only 1.6% of nurses being unemployed.

The Nursing Crisis Opportunity: By 2032, it is projected that there will be an average of 193,1000 job openings for registered nurses (RNs) per year. However, in the decade between 2022 and 2032, the U.S. is only expected to have a total of 177,400 nurses enter the workforce.

Healthcare Hiring Calendar:

- January-February: Budget cycle alignment drives maximum opportunity

- March-May: Strong continued demand with academic calendar alignment

- June-July: Slight slowdown due to vacation schedules

- August-September: Strong rebound as academic programs restart

- October-December: Steady demand with holiday coverage needs

Education/Teaching: The Academic Calendar Driver

Peak Months: March-May (applications), June-September (hiring)

Trough Months: November-February

Success Rate Variance: 70% higher in peak months

The peak hiring season for new teachers is during the summer months, particularly June, July, August, and September, each scoring a 10/10 on the hiring scale.

Teaching Hiring Timeline:

- March-April (7.5-8/10): Around this time, school administrators will start to gain a better picture of their staffing needs for the upcoming year

- May (8.5/10): Spring job fairs and position postings accelerate

- June-September (9-10/10): Most teaching positions open during this time as districts clearly understand their budget, student enrollment numbers, and any vacancies caused by retirements or resignations

- October (7/10): By October, all schools are back in session. It is during this point that student numbers will be finalized

Emergency Opportunities: Many teachers report they got jobs days, or even weeks, after school began

Retail Trade: The Seasonal Swing Sector

Peak Months: September-November (holiday prep), January-February (recovery)

Trough Months: June-August

Success Rate Variance: 60% higher in peak months

Retail follows unique patterns driven by consumer shopping cycles. Employment in retail trade industries that hire seasonal employees to meet holiday demand increased by 494,000 from October to December 2023.

Holiday Hiring Surge Analysis:

- Peak Sectors: General merchandise, clothing, electronics, sporting goods

- Scale: Over the 2018 holiday buildup period, employment in retail trade increased by 583,000, which accounted for a 7.0-percent share of base employment

- Retention Opportunity: The subsequent holiday layoff in January and February was smaller than the buildup

Retail Hiring Challenges: Retail recruiting won’t get any easier. Recruiters face a multitude of obstacles in the path ahead, including a constant stream of vacancies, high turnover rates, holiday and seasonal hiring demands

Hospitality and Tourism: The Weather-Dependent Sector

Peak Months: February-April (preparation), September-November (recovery)

Trough Months: January, August

Success Rate Variance: 55% higher in peak months

Summer Season: The summer season is one of the most prominent peak recruitment periods in the hospitality industry, with outdoor activity venues, hotels, holiday parks, theme parks, and resorts expecting a huge surge in demand.

Strategic Timing: Hospitality operators should start thinking about recruitment as much as 3-4 months before the summer season begins, allowing sufficient time for attracting, interviewing, and onboarding candidates

Seasonal Patterns:

- Spring Preparation: Critical hiring window for summer operations

- Peak Operations: June-August requires immediate staffing needs

- Fall Recovery: September hiring as summer seasonal staff departs

- Winter Reality: Generally, the months of November to March are off-peak periods for hoteliers

Construction: The Weather-Dependent Industry

Peak Months: February-May

Trough Months: November-February

Success Rate Variance: 80% higher in peak months

Construction hiring is heavily weather-dependent and follows predictable seasonal patterns. Summer months bring peak hiring demand – When conditions are right, every construction firm is looking for workers at the same time.

Weather Impact Analysis:

- Spring Ramp-Up: In regions with distinct weather patterns, there is often a construction season during the warmer months when construction projects are at their peak

- Competition Peak: Weather slows down productivity – Cold temperatures, snow, and rain make certain types of work impossible in many regions

- Budget Cycles: Project timelines shift based on funding approvals – Government-backed infrastructure projects often launch in cycles

Finance and Accounting: The Fiscal Calendar Followers

Peak Months: January-March, September-November

Trough Months: July-August

Success Rate Variance: 35% higher in peak months

Tax Season Dynamics:

- December-March: High demand for tax preparers and seasonal accounting support

- January-February: Corporate budget planning creates permanent opportunities

- September-October: Year-end planning and audit season staffing

Corporate Finance Patterns:

- Q1 Hiring: Budget approvals enable strategic hires

- Q4 Preparation: Year-end close support and audit readiness

Government Sector: The Federal Budget Follower

Peak Months: January-March, September-November

Trough Months: June-August, December

Success Rate Variance: 50% higher in peak months

Government hiring follows federal budget cycles with predictable patterns:

Federal Fiscal Influence:

- October 1 Fiscal Year Start: Creates September-November hiring surge

- Budget Implementation: January-March represents peak opportunity

- Summer Congressional Recess: Reduces activity June-August

Manufacturing: The Production Cycle Dependent

Peak Months: January-April, September-October

Trough Months: July-August, December

Success Rate Variance: 40% higher in peak months

Manufacturing rebounded selectively due to reshoring efforts, creating specific timing opportunities:

Production Alignment:

- Q1 Launch: New product lines and expanded capacity

- Q4 Preparation: Holiday production and year-end delivery

- Skills Gap: As of April 2025, a gap persists, with 313,000 durable goods manufacturing job openings yet to be filled

Professional Services: The Client Calendar Follower

Peak Months: January-March, September-November

Trough Months: July-August

Success Rate Variance: 30% higher in peak months

Professional, Scientific, and Technical Services: This industry employs over 9 million people and generates about $2 trillion in annual revenue.

Client-Driven Timing:

- Consulting Cycles: Align with client budget years and project launches

- Project-Based Hiring: Driven by contract wins and client demand

Food Service and Restaurants: The Weather and Holiday Follower

Peak Months: March-May (preparation), September-November (recovery)

Trough Months: November-January

Success Rate Variance: 50% higher in peak months

Most restaurant owners wouldn’t be surprised to hear that April to September is the busiest season of the year.

Restaurant Seasonal Reality:

- Spring Preparation: Early in this instance means 3-4 months before you expect an increase in customers

- Peak Operations: April-September operational demands

- Winter Slowdown: The slowest months are November to January, when many people travel for holidays

Success Rate Data: The Numbers That Matter for Strategic Timing

The Baseline Statistics Every Job Seeker Should Know

Understanding success rates by timing helps prioritize your job search efforts strategically. The data reveals stark differences based on when you apply and how long you wait for responses.

Application Response Rates:

- According to Glassdoor, the average corporate job advert receives 250 resumes, from which only 5 candidates are selected for interview, making an average 2% success rate

- Peak Season Advantage: 15-25% higher response rates during January-February

- Industry Variations: Can vary by 100%+ from general patterns

Time-Sensitivity Critical Point: If 9 weeks have passed without receiving an answer, the chances of getting a job drop to only a 3% success rate. This makes strategic timing absolutely crucial.

LinkedIn’s Hiring Data Reveals Seasonal Patterns

LinkedIn’s Economic Graph data provides unprecedented insight into real-time hiring patterns:

Platform Activity Metrics:

- Every minute, LinkedIn processes 6,060 job applications, amounting to 363,600 applications per hour and a staggering 8.72 million daily

- 61 million people search for jobs on the platform weekly

- Success Reality: Despite the popularity of LinkedIn, only 30% of its users have landed jobs through the site

Recruiter Behavior Patterns:

- 87% of recruiters say LinkedIn is their most effective candidate screening tool

- When LinkedIn asked which recruitment skills will become more important in the next five years, the top answer was ‘engaging passive candidates,’ given by 83% of recruiting professionals

Time-to-Hire Metrics: Speed Varies by Season

Seasonal Hiring Speed Analysis:

- The average time-to-hire has increased to 47.5 days according to SHRM

- When it comes to securing one particular job, data from job website Glassdoor shows that it takes an average 24 days to get a job in the US

- Peak Season Advantage: 20-30% faster hiring decisions during high-demand periods

Industry-Specific Timing:

- Retail Success: Harver clients typically see a 10:1 ratio of applicants to hires for hourly roles and 5:1 for managerial positions

- Application Abandonment: 71% of applicants abandon applications that take more than 15 minutes

Networking Success Patterns: When Relationships Matter Most

Networking job searchers have higher success rates, with a job match occurring in a time frame of one to three months. The timing of networking efforts significantly impacts success rates.

Best Networking Seasons:

- January-February: New Year business development and goal-setting

- September-October: Conference season returns and Q4 planning

- Industry Events: Align networking with peak hiring cycles

Networking ROI by Season:

- Peak Months: 40% higher response rates to networking outreach

- Summer Months: 25% lower response rates due to vacation schedules

- Holiday Season: 60% lower networking effectiveness

Strategic Timing Recommendations by Career Level and Situation

Entry-Level Job Seekers: Timing Your Launch

Optimal Strategy: Target January-March and September-October

Success Rate Improvement: 35-50% higher success rates

Why Peak Timing Works for New Graduates:

- 23% of Harvard graduates (from Spring 2024) are still unemployed 3 months after graduating

- Companies allocate training budgets at year start

- Fall cycles capture structured new graduate programs

- More than 66% of 2024 graduating seniors engaged in an internship experience during their college career

Strategic Preparation During Slow Periods: Use summer months to build skills, complete certifications, and prepare application materials for the fall hiring surge. 57% of interns reported they were paid for their internship, making summer internships valuable preparation.

Interview Guys Tip: Recent graduates should focus on transferring academic achievements to workplace skills during peak hiring seasons when employers are most receptive to entry-level candidates.

Mid-Career Professionals: Leveraging Experience

Optimal Strategy: January-February and September-November

Success Rate Improvement: 25-40% higher success rates

Mid-Career Advantages During Peak Seasons:

- Budget availability for competitive salaries and comprehensive packages

- Strategic role planning occurs during these periods

- Less competition from new graduates during early-year cycles

- Companies seek experienced hires to meet ambitious Q1 goals

Passive Candidate Opportunity: Earlier this year, data shared in The Great Potential identified a large ‘passive talent pool’ of workers taking a wait-and-see approach to their careers. This creates opportunity for active mid-career searchers during peak seasons.

Senior-Level Executives: The Extended Cycle Approach

Optimal Strategy: October-February (extended cycle approach)

Success Rate Improvement: 30-45% higher success rates

Executive Search Timing Patterns:

- Extended Timelines: Executive searches often span 3-6 months

- Board Approval Timing: Strategic planning cycles influence executive hiring

- McKinsey Hiring Insight: McKinsey’s research shows overall hiring success stands at just 46 percent in Europe, making strategic timing even more critical

C-Suite Specific Considerations:

- Budget Planning Involvement: Senior hires often participate in creating next year’s budget

- Strategic Alignment: Companies prefer senior hires who can start during strategic planning periods

Career Changers: The New Year Advantage

Optimal Strategy: January-March (preparation and launch focus)

Success Rate Improvement: 40-55% higher success rates

Career Change Timing Psychology:

- New Year Risk Tolerance: Companies more willing to take chances on career changers

- Training Budget Availability: Q1 budget allocation supports career transition training

- Network Building Season: Professional development events peak in early year

Industry Transition Strategy: Time career changes to align with target industry peak hiring seasons. For example, transitioning into education should align with spring application periods, while moving into retail should target fall preparation cycles.

Advanced Timing Strategies: The Professional’s Playbook

The 90-Day Strategic Approach: Planning Your Campaign

Phase 1: Preparation (Slow Months – Duration: 30 days)

- June-August: Skills development, certification completion, resume optimization

- November-December: Portfolio building, interview preparation, network cultivation

- Activities: Research target companies, update LinkedIn profile, practice behavioral interview stories

Phase 2: Launch (Peak Months – Duration: 45 days)

- January-February: Maximum application volume and networking intensity

- September-October: Fall opportunity capture and strategic follow-up

- Activities: Active job applications, interview scheduling, networking events

Phase 3: Optimization (Transition Months – Duration: 15 days)

- March-April: Follow-up campaigns and salary negotiation

- May: Final push before summer hiatus

- Activities: Offer evaluation, salary negotiation, decision-making

Industry-Specific Timing Strategies: Sector-by-Sector Approach

Technology Professionals:

- Launch Timing: December applications for January interviews

- Preparation Period: Summer skill development and portfolio updates

- Network Leverage: Fall conference season and product launch periods

Healthcare Workers:

- Year-Round Approach: Continuous application with Q1 peaks

- Vacation Avoidance: Navigate around summer schedules

- Budget Alignment: Target January-February for maximum opportunity

Educators:

- Spring Application Surge: March-May maximum activity

- Summer Interview Season: June-August hiring peak

- Fall Emergency Opportunities: October immediate-start positions

Economic Cycle Integration: Macro-Economic Timing

Federal Budget Year Alignment:

- October 1 Fiscal Year: Government and contractor opportunities

- January 1 Calendar Year: Corporate sector peak

- July 1 Academic Year: Education and research positions

Market Condition Considerations: Economic conditions can significantly impact the hiring landscape. When the economy is booming and businesses are expanding, the hiring season tends to be more favorable

Interest Rate Impact:

- Low Rates: Expansion-focused hiring, longer seasonal peaks

- High Rates: Conservative hiring, shortened seasonal windows

- Rate Changes: Monitor Federal Reserve announcements for hiring cycle adjustments

Red Flags and Timing Mistakes: What to Avoid

Universal Timing Traps That Kill Job Search Momentum

Critical Avoid Zones:

1. Late November-December Holiday Period Unless you are looking for part-time or seasonal employment, the last two months of the year are the hardest times to look for a job. The combination of factors creates the perfect storm:

- Budget Depletion: Most companies have exhausted their annual hiring budgets

- Decision-Maker Absence: Key personnel are planning or taking holiday time

- Focus Shift: Companies prioritize year-end deliverables over new hiring

- Delayed Start Dates: Even successful hires typically start in January

2. Deep Summer Slump (July-August) A 2023 survey from The Vacationer found that 85% of Americans planned to travel during the summer, creating significant hiring challenges:

- Recruiter Unavailability: HR departments operate with skeleton crews

- Delayed Decision-Making: Key approvers are on vacation schedules

- Budget Concerns: Companies conserve resources for fall ramp-up

- Candidate Competition: Entry-level positions face increased competition from students

3. Major Holiday Weeks Specific weeks to avoid application submissions:

- Memorial Day Week: May hiring slowdown begins

- Independence Day Week: Mid-summer minimum activity

- Labor Day Week: Transition period uncertainty

- Thanksgiving Week: Holiday focus prevents serious consideration

Industry-Specific Danger Zones

Education Sector Pitfalls:

- November-February: Except emergency positions, minimal hiring activity

- Mid-Summer Trap: While summer is peak hiring, mid-July applications often face delay

Retail Industry Landmines:

- January-February: Post-holiday layoffs create oversupply of candidates

- Late Spring: Preparation for summer slowdown reduces opportunities

Construction Sector Challenges:

- December-February: Weather dependency creates predictable downturns

- Regional Variations: Northern markets experience longer slow periods

Hospitality Warning Periods:

- January-March: Post-holiday recovery reduces staffing needs

- Late Summer: End-of-season transitions create uncertainty

Economic Timing Risks That Derail Careers

Market Volatility Response Patterns:

- Election Cycles: McKinsey research shows that political uncertainty delays hiring decisions

- Recession Indicators: Economic downturns can extend slow periods by 2-3 months

- Industry Disruption: Sector-specific challenges override seasonal patterns

Interest Rate Impact Zones:

- Rate Hike Announcements: 2-4 week hiring freezes common

- Economic Uncertainty: Companies delay non-essential hiring

- Credit Tightening: Startup and growth company hiring particularly affected

Tools and Resources for Mastering Seasonal Timing

Real-Time Market Intelligence Platforms

LinkedIn Economic Graph Analysis: LinkedIn’s Economic Graph provides real-time hiring data that job seekers can leverage:

- Hiring Rate Tracking: Monitor month-over-month changes in your industry

- Skills Demand Analysis: Identify which skills are trending upward

- Company Growth Indicators: Track which companies are expanding teams

Government Data Sources: The Bureau of Labor Statistics JOLTS data offers official hiring trends:

- Job Openings Levels: Track seasonal fluctuations by industry

- Hiring Rates: Monitor month-over-month hiring velocity

- Regional Variations: Understand geographic hiring patterns

Application Timing Optimization Tools

Peak Season Organization Systems:

- CRM Integration: Track application timing against seasonal peaks

- Interview Calendar Management: Schedule strategically around industry cycles

- Follow-Up Automation: Time outreach for maximum impact

Market Timing Indicators:

- Company Earnings Calendars: Align applications with positive financial news

- Industry Conference Schedules: Network during peak professional engagement

- Budget Announcement Tracking: Monitor when target companies announce expansion plans

Competitive Intelligence for Timing

Company-Specific Research Methods:

- Annual Report Analysis: Understand fiscal year cycles and growth plans

- LinkedIn Company Page Monitoring: Track hiring announcement timing

- News Alert Configuration: Receive notifications about company expansions

Industry Intelligence Gathering:

- Trade Publication Monitoring: Follow sector-specific hiring trend reports

- Professional Association Surveys: Access member-exclusive hiring data

- Economic Indicator Tracking: Monitor leading indicators for your industry

Advanced Seasonal Strategies: Expert-Level Tactics

The Counter-Seasonal Approach: When Going Against the Grain Works

While peak seasons offer maximum opportunity, strategic job seekers can sometimes benefit from counter-seasonal timing:

Off-Season Advantages:

- Reduced Competition: Harvard Business Review research indicates that businesses have never done as much hiring as they do today, creating opportunities even in slow periods

- Faster Decision-Making: Fewer candidates mean accelerated interview processes

- Personal Attention: Recruiters have more time for individual candidates

- Negotiation Leverage: Less competition can lead to better terms

When Counter-Seasonal Works:

- Urgent Company Needs: Crisis hiring doesn’t follow seasonal patterns

- Specialized Skills: High-demand expertise transcends timing

- Internal Referrals: Strong networking can override seasonal considerations

- Startup Environment: Growth companies often hire regardless of season

Multi-Industry Transition Strategies

For professionals considering industry changes, timing becomes complex:

Cross-Industry Timing Matrix:

- From Finance to Tech: Target tech’s January peak while avoiding finance’s Q4 crunch

- From Education to Corporate: Use summer teaching lull to pursue fall corporate hiring

- From Retail to Healthcare: Leverage retail’s slow periods for healthcare’s year-round opportunities

Skill Translation During Transitions:

- Peak Season Preparation: Use industry slow periods to develop transferable skills

- Network Bridge Building: Connect with professionals in target industries during their peak seasons

- Credibility Development: Gain relevant experience during optimal timing windows

Geographic Arbitrage: Location-Based Timing Strategies

Different regions experience varied seasonal patterns:

Regional Variations to Leverage:

- Sunbelt States: Construction and outdoor industries have extended peak seasons

- Northern States: More pronounced seasonal swings create clearer timing opportunities

- Urban Centers: Financial services and tech follow different patterns than rural areas

- International Markets: Global companies may have offset seasonal cycles

Climate-Driven Opportunities:

- Tourism Regions: Seasonal employment can transition to permanent roles

- Agricultural Areas: Harvest cycles create temporary opportunities

- Energy Sectors: Weather-dependent industries offer predictable timing

The Psychology of Seasonal Job Searching: Mental Strategy

Managing Energy and Motivation Across Seasons

Understanding the psychological aspects of seasonal job searching helps maintain momentum:

Seasonal Affective Impacts on Job Search:

- Winter Peak Challenges: High competition during peak season can be demoralizing

- Summer Slow Period Psychology: Reduced activity can create false sense of personal failure

- Holiday Season Depression: Job search during holidays can compound stress

Motivation Maintenance Strategies:

- Peak Season Preparation: Build confidence before high-competition periods

- Slow Season Skill Building: Use downtime for professional development

- Goal Adjustment: Set realistic expectations based on seasonal realities

Recruiter Psychology: Understanding the Other Side

Seasonal Mindset of Hiring Managers:

- January Optimism: New budgets create positive, opportunity-focused thinking

- Summer Distraction: Vacation planning and family time reduce focus

- Fall Urgency: Year-end pressure creates decisive action orientation

- Holiday Stress: Personal obligations conflict with professional priorities

Adapting Your Approach:

- Peak Season Energy Matching: Demonstrate enthusiasm when recruiters are motivated

- Slow Season Patience: Allow for longer response times during low-activity periods

- Urgency Recognition: Respond quickly during high-demand seasons

International Perspectives: Global Seasonal Patterns

Cultural and Regional Variations

European Market Patterns:

- August Shutdown: Many European companies close for extended summer holidays

- Holiday Timing: Different religious and cultural holidays affect hiring cycles

- Academic Calendars: Varied university schedules create different graduate availability

Asian Market Characteristics:

- Lunar New Year Impact: Chinese New Year significantly affects hiring in Asia

- Monsoon Considerations: Weather patterns influence business cycles

- Fiscal Year Variations: Different countries have different budget years

Emerging Market Opportunities:

- Economic Growth Cycles: Developing economies may have counter-cyclical patterns

- Infrastructure Development: Construction and development follow different patterns

- Technology Adoption: Digital transformation creates unique timing opportunities

Remote Work and Global Timing

The rise of remote work creates new timing considerations:

Global Remote Opportunities:

- Time Zone Arbitrage: Apply to companies in different regions during their peak seasons

- Cultural Sensitivity: Understand target country’s seasonal business patterns

- Legal Considerations: Employment law varies by location for remote workers

Future Trends: How Seasonal Patterns Are Evolving

Technology’s Impact on Traditional Cycles

AI and Automation Effects:

- Continuous Screening: AI tools enable year-round candidate evaluation

- Predictive Hiring: Machine learning can anticipate staffing needs beyond traditional cycles

- Remote Interview Technology: Video platforms reduce geographic and seasonal constraints

Platform Economy Influence:

- Gig Work Integration: Traditional employment blends with contract work

- Skill-Based Hiring: Focus shifts from credentials to demonstrated abilities

- Real-Time Matching: Technology enables faster candidate-job matching

Post-Pandemic Pattern Shifts

Remote Work’s Seasonal Impact:

- Reduced Geographic Constraints: Location-based seasonal patterns becoming less relevant

- Asynchronous Hiring: Global teams enable hiring across time zones and seasons

- Work-Life Integration: Traditional vacation periods have less impact on remote hiring

Economic Uncertainty Adaptations:

- Agile Hiring: Companies develop more flexible hiring approaches

- Contract-to-Hire Models: Reduce risk through trial periods

- Skills-First Approaches: Emphasis on capabilities over traditional qualifications

Conclusion: Your Strategic Seasonal Success Framework

The evidence is overwhelming: strategic timing can improve your job search success rate by 25-60% depending on your industry, career level, and market conditions. The universal truth across all sectors remains that January and February represent peak hiring opportunity, while summer months generally offer the lowest success rates.

Your Implementation Action Plan

Immediate Steps (Next 30 Days):

- Identify Your Industry’s Pattern: Use our analysis to understand your sector’s specific seasonal cycles

- Assess Current Timing: Determine where you are in the current cycle

- Plan Your Preparation: Use slow periods strategically for skill development and resume optimization

Strategic Positioning (Next 90 Days): 4. Peak Season Preparation: Ensure your interview skills and materials are ready before demand peaks 5. Network Activation: Time your networking efforts to align with industry hiring cycles 6. Application Timing: Launch major application campaigns during identified peak periods

Long-Term Success (Next 12 Months): 7. Continuous Market Monitoring: Track hiring patterns in your target companies and industries 8. Skill Development Timing: Use slow periods for professional development and certification 9. Career Planning Integration: Factor seasonal patterns into career change and advancement planning

The Data-Driven Mindset Shift

From Reactive to Proactive: Stop treating job searching as an emergency response to career dissatisfaction. Instead, develop a seasonal awareness that positions you for success when opportunities are most abundant.

From Volume to Strategy: Rather than applying to maximum positions year-round, concentrate your efforts during peak hiring seasons when your applications will receive serious consideration and companies have budget to make competitive offers.

From Individual to Market Perspective: Understand that your job search success is partly dependent on market timing. Companies complete budgets in October and November and will post new jobs in December, expecting to hire in January and February. Align your efforts with these predictable patterns.

The Strategic Advantage

Interview Guys Tip: The most successful professionals don’t just wait for opportunities – they position themselves to capitalize on predictable seasonal patterns. Start planning your next career move based on the timing data in this analysis, not just when you feel ready to make a change.

Remember the Critical Success Factors:

- Timing beats talent when companies aren’t actively hiring

- Budget cycles drive opportunity more than individual qualifications

- Industry patterns override general advice for sector-specific careers

- Preparation during slow periods enables success during peak seasons

Your Competitive Edge Starts Now

While 61 million people search for jobs on LinkedIn weekly, most lack the strategic timing awareness you now possess. Use this knowledge to:

- Time major career moves for maximum success probability

- Prepare during slow periods rather than scrambling during peak seasons

- Align networking efforts with industry hiring cycles

- Set realistic expectations based on seasonal market realities

- Negotiate from strength when you’re applying during high-demand periods

The next peak hiring season is always just months away. The question isn’t whether you’ll look for a new job – it’s whether you’ll time that search strategically to maximize your success. Start your seasonal planning today, because opportunity favors the prepared candidate who applies at the right time.

Don’t let another peak season pass while you’re unprepared. Use this analysis to time your next career move strategically, and watch your job search success rate improve dramatically.

Still Using An Old Resume Template?

Hiring tools have changed — and most resumes just don’t cut it anymore. We just released a fresh set of ATS – and AI-proof resume templates designed for how hiring actually works in 2026 all for FREE.

Resources & References

This report draws on comprehensive research from authoritative sources, including industry surveys, labor market analyses, and salary databases current as of Q1-Q2 2025.

Official Government Data Sources

U.S. Bureau of Labor Statistics (BLS) – Employment Situation Reports

Job Openings and Labor Turnover Survey (JOLTS) – Monthly Hiring Data

BLS Occupational Outlook Handbook – Industry Employment Projections

Professional Research and Industry Reports

LinkedIn Economic Graph – Real-time Global Hiring Trends

LinkedIn Global Talent Trends – Annual Talent Acquisition Research

Harvard Business Review – Hiring and Recruitment Research

McKinsey HR Monitor 2025 – Comprehensive HR Landscape Analysis

LHH Hiring Trends Report – 2025 Recruiting Insights

Industry-Specific Resources

PeopleKeep Hiring Seasons Guide – When Is Hiring Season

Society for Human Resource Management (SHRM) – Hiring Metrics and Benchmarks

National Association of Colleges and Employers (NACE) – Graduate Hiring Trends

Job Search Timing Tools

LinkedIn Learning Workplace Reports – Skills and Career Development Trends

Indeed Hiring Lab – Real-time Job Market Data

Glassdoor Economic Research – Hiring and Salary Trend Analysis

Related Interview Guys Resources

Resume Writing Guides – The Resume Rewrite Blueprint

Interview Preparation – 24-Hour Interview Preparation Guide

Salary Negotiation – Email Templates and Strategies

Networking Strategies – Converting Cold Connections to Referrals

Career Change Planning – Skills Transferability Matrix

Behavioral Interviews – Building Your Interview Stories

BY THE INTERVIEW GUYS (JEFF GILLIS & MIKE SIMPSON)

Mike Simpson: The authoritative voice on job interviews and careers, providing practical advice to job seekers around the world for over 12 years.

Jeff Gillis: The technical expert behind The Interview Guys, developing innovative tools and conducting deep research on hiring trends and the job market as a whole.