The $5,000 Career Change Tax: Industries That Penalize (And Reward) Career Switchers

Changing careers sounds empowering until you see your first paycheck in the new role.

While career coaches celebrate your courage and LinkedIn influencers applaud your authenticity, there’s a harsh financial reality nobody discusses during those motivational pep talks.

Career changers face an average pay penalty of approximately $5,000 per year, with hourly wages running 14% lower when switching sectors compared to those who stay put.

That’s not a temporary adjustment period. That’s real money leaving your bank account every single month.

Here’s the twist that makes this even more complicated. Approximately 59% of U.S. professionals are actively seeking new job opportunities, yet most have no idea which industries will welcome them with competitive compensation and which will slam the door on their earning potential for years.

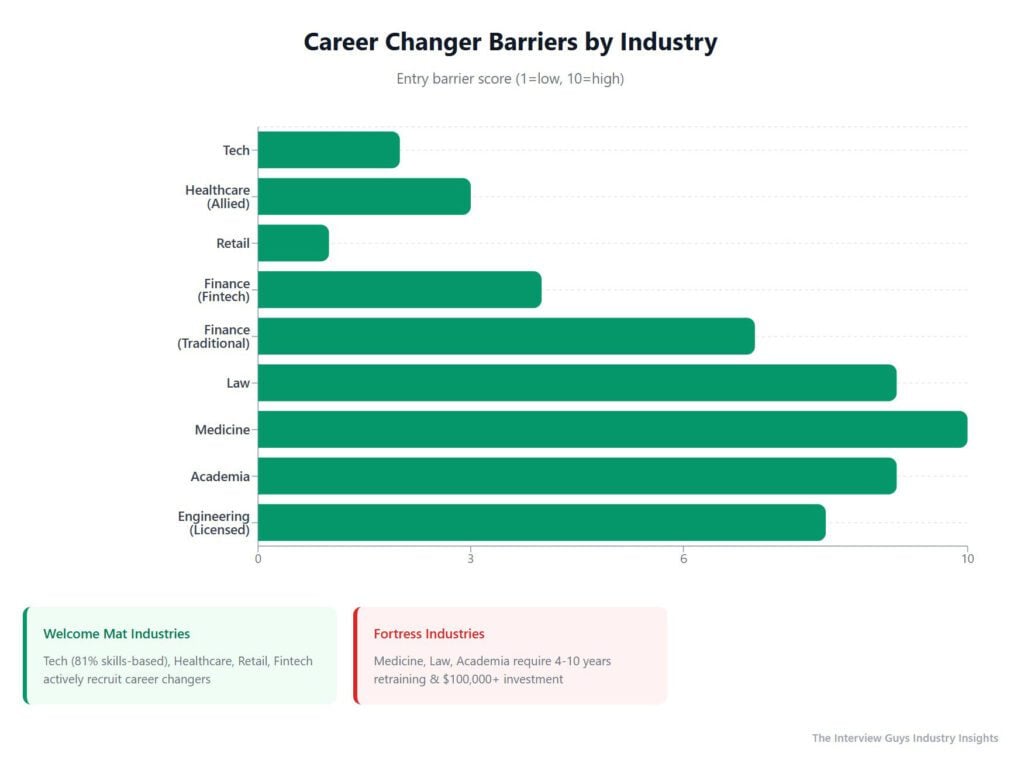

The career change penalty isn’t universal.

Some industries have rolled out the red carpet for career switchers, eliminating degree requirements and creating apprenticeship programs specifically designed for people changing fields. Others have built fortress-like barriers that can cost you years of earnings and require massive retraining investments.

This article breaks down exactly which industries reward career changers and which ones penalize them financially. You’ll discover the specific sectors where your transferable skills command premium compensation, and where you’ll face an uphill battle.

More importantly, you’ll learn strategies to minimize your personal switching tax regardless of your target industry.

☑️ Key Takeaways

- Career changers face an average pay penalty of $5,000 per year, with hourly wages 14% lower when switching sectors compared to staying put

- Tech, healthcare, and retail lead in welcoming career changers through skills-based hiring and apprenticeship programs, with 81% of employers now using competency-focused recruitment

- Highly credentialed industries like law, medicine, and traditional finance create fortress-like barriers that can cost switchers years of earning potential and require extensive retraining

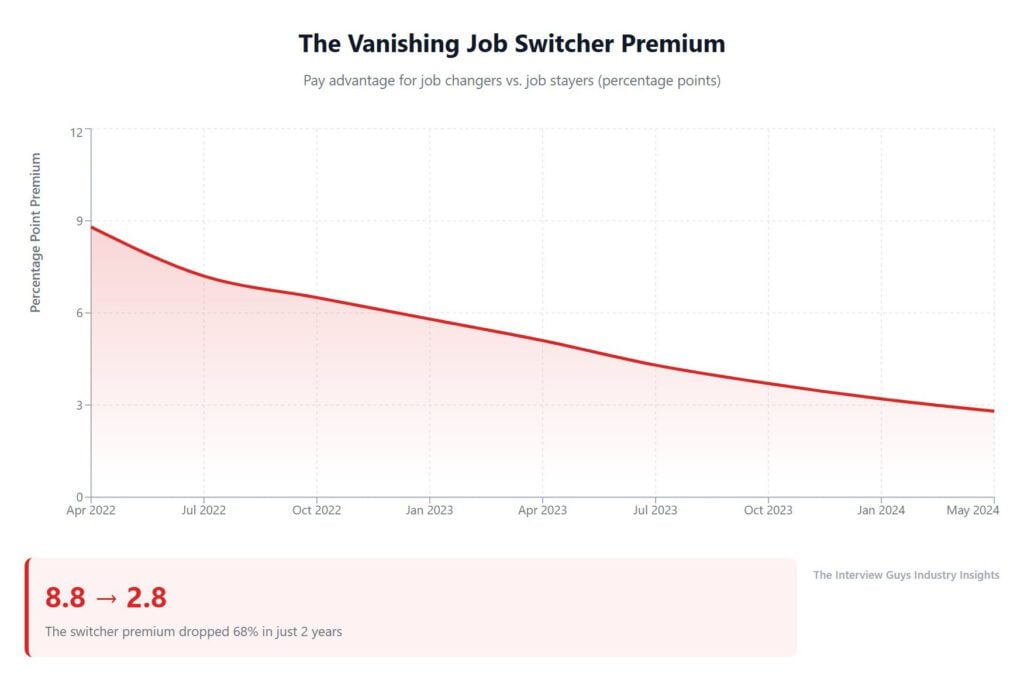

- The gap between job switchers and job stayers has narrowed dramatically, from 8.8 percentage points in 2022 to just 2.8 percentage points in 2024, signaling a cooling job market

The Real Numbers Behind Career Change Penalties

Let’s start with the uncomfortable truth that most career counselors gloss over during your exploration phase.

The Average Tax on Career Switching

According to the Learning & Work Institute’s comprehensive “All Change” report, the average career changer experiences a £3,731 annual pay penalty, translating to roughly $5,000 in lost earnings every year.

This isn’t about taking an entry-level position temporarily. Half of all career changers report earning less than they did before making the switch, and the recovery timeline typically spans three to five years before you match your previous compensation level.

The math gets worse when you factor in opportunity cost. While your former colleagues receive annual raises and promotions, you’re rebuilding from a lower baseline. That compounds over time into a substantial lifetime earnings gap unless you’re strategic about which industry you target.

Why the Gap Is Narrowing (But Not Disappearing)

But there’s an interesting development that changes the calculation.

Research from Statista analyzing ADP payroll data shows the premium that job switchers once enjoyed has narrowed dramatically, from an 8.8 percentage point advantage in April 2022 to just 2.8 percentage points by May 2024.

The Great Resignation made job hopping extremely lucrative for a brief window. That window has closed.

BambooHR’s 2024 Compensation Trends report found that only 21% of salaried workers changed employers in 2024, down sharply from 34% in 2022.

The labor market has cooled, and with it, the switching premium has evaporated for most workers. Those who did successfully change jobs in 2024 saw an average salary increase of just 13.9%, nearly half the premium from the previous year.

The Hidden Variables That Affect Your Personal Tax

Several variables determine whether you’ll face a steep penalty or minimal impact:

- Education level matters significantly. Workers with degree-level qualifications are 20% more likely to change jobs within the same sector, effectively avoiding the career change penalty altogether. Meanwhile, those with lower qualifications are 30% more likely to switch sectors, exposing themselves to the full financial impact.

- Age creates a massive difference. Younger workers are three times more likely to successfully switch sectors than older professionals. This reflects both employer biases and the reality that younger workers have less to lose financially during the transition period.

- Senior positions see different outcomes. Career changers who successfully navigate the switch at management levels see the highest rewards. Senior director positions command a 15% pay increase when moving to new companies, significantly better than the overall average.

Interview Guys Tip: Before making a career switch, calculate your personal “switching tax” by researching entry-level salaries in your target field and comparing them to your current compensation. Factor in 3-5 years to recover financially, not just the first-year difference. Use salary research tools and talk to people currently working in your target role to get realistic numbers.

Discover Your Top 8 Perfect Career Matches in 60 Seconds

Take our quick “Career Code” Assessment and get your top 8 career matches. We rank these based on your unique combination of strengths, energy patterns, and motivations

The Welcome Mat Industries: Where Career Changers Thrive

Not all industries treat career changers as risky bets. Some sectors have embraced skills-based hiring with such enthusiasm that your non-traditional background becomes an asset rather than a liability.

Technology & Software: The Skills-First Pioneer

The tech industry has led the revolution in welcoming career changers.

TestGorilla’s State of Skills-Based Hiring 2024 report reveals that 81% of employers now use skills-based hiring practices, up dramatically from just 56% in 2022.

This isn’t just talk. Major technology companies have eliminated degree requirements for many positions.

Google, IBM, Apple, and Microsoft now evaluate candidates based on what they can do rather than where they studied. This opens doors for career changers who’ve built technical skills through bootcamps, self-study, or adjacent work experience.

According to Dice’s 2025 Tech Salary Report, the average tech professional earns $112,521, though salary growth remained modest at just 1.2% in 2024.

The real opportunity for career changers lies in specialized skills. Tech workers with AI expertise command an 18% salary premium compared to their counterparts without these skills.

Major tech companies have created formal pathways for career changers through apprenticeship programs:

- Google offers paid apprenticeships for candidates at any education level

- LinkedIn developed the REACH program specifically for career changers and bootcamp graduates

- Airbnb runs a six-month paid program for aspiring software engineers from non-traditional backgrounds

- Pinterest actively recruits self-taught developers

The data shows tech professionals with 3-5 years of experience saw the biggest pay raises in 2024, with nearly 6% increases. This suggests that once you break into tech and prove your capabilities, the industry rewards growth quickly.

Healthcare & Social Assistance: Desperate for Talent

Critical worker shortages have transformed healthcare into one of the most welcoming industries for career changers.

The sector has moved aggressively to create alternative pathways into healthcare roles beyond traditional four-year nursing programs.

According to the White House Council of Economic Advisers’ analysis of registered apprenticeships, healthcare apprenticeship programs exploded from virtually zero in early 2021 to operating in 46 states by late 2024.

California alone invested $30 million in apprenticeship funding specifically targeting healthcare, education, and advanced manufacturing roles.

The apprenticeship model allows career changers to earn while they learn, eliminating the financial cliff that makes switching so risky. Healthcare facilities increasingly prioritize hands-on experience and adaptability over formal credentials for many positions, particularly in:

- Allied health roles

- Medical administration

- Healthcare technology

- Clinical research coordination

- Patient advocacy

The Bureau of Labor Statistics projects healthcare jobs will grow much faster than average through 2034, creating sustained demand that benefits career changers willing to invest in relevant training.

Retail & Hospitality: The Entry Point Industries

These sectors serve as launching pads for many career changers, though with important caveats.

Retail (54%) and hospitality (48%) have the highest rates of employees planning to job hunt, according to industry surveys. A full 25% of all job changers come from retail and hospitality backgrounds.

The barriers to entry are low. These industries have shifted focus to digital commerce skills over traditional retail experience, opening opportunities for career changers with technology backgrounds.

The shortest median career tenure of just 2.3 years creates constant openings.

The downside? Lower overall compensation compared to other sectors.

These industries work well as transition points where you can gain customer service, operations, or management experience that transfers to better-paying fields. Many successful career changers use retail or hospitality as bridge industries rather than final destinations.

Finance: The Emerging Opportunity (With Caveats)

The finance sector presents a split personality for career changers.

TestGorilla’s research found that 80% of finance employees prefer skills-based hiring processes, running 12 percentage points higher than the industry-wide average.

Consulting, software, and banking roles in finance maintain average salaries exceeding $125,000, significantly higher than most industries.

Manufacturing roles requiring technology skills showed an impressive 15.1% salary increase in 2024, making tech-adjacent finance positions particularly attractive.

However, there’s a warning sign. According to comprehensive career change statistics, 65% of finance and insurance sector employees either transitioned to different industries or exited the workforce entirely in recent years.

Traditional investment banking and private equity remain fortress industries with high barriers. But fintech, financial services, and corporate finance roles have become increasingly accessible to career changers, especially those bringing:

- Analytical skills

- Technology expertise

- Business development experience

- Data analysis capabilities

Understanding how to negotiate salary with zero experience becomes critical in finance, where starting salaries vary widely based on your ability to articulate transferable value.

The Fortress Industries: Where Career Changers Face Steep Penalties

While some industries embrace career changers, others have constructed nearly impenetrable barriers.

Understanding these obstacles helps you make realistic decisions about whether the investment required makes financial sense.

Medicine & Healthcare Credentialed Roles: The Licensed Lockout

The irony of healthcare is stark. While allied health positions welcome career changers, physician and advanced practice roles remain locked behind extensive requirements.

Legal and ethical standards mandate specific degrees and certifications that can take 4-8 years to complete.

The foreign-trained physician problem illustrates this clearly. Approximately 65,000 out of 247,000 foreign-trained doctors in the United States are not practicing despite having medical qualifications from their home countries.

Credential transfer barriers, licensing exam requirements, and residency position limitations create a nearly impossible path for many qualified individuals.

Career changers considering medical school face retraining costs exceeding $40,000 for just one year of full-time education. Medical school itself typically costs $150,000-$300,000 and requires four years, followed by 3-7 years of residency training at relatively low pay.

The opportunity cost is staggering. A 35-year-old career changer pursuing medicine would be nearly 50 before earning a full physician salary, having sacrificed a decade of peak earning years from their previous career.

Exceptions exist in:

- Medical administration

- Healthcare technology

- Clinical research coordination

- Medical sales

- Healthcare consulting

These roles value clinical knowledge but don’t require medical degrees.

Law & Legal Services: The JD Requirement Wall

Legal practice requires passing the bar examination and holding a law degree for virtually all attorney positions. This creates a minimum 3-year, $150,000+ investment before you can practice.

The opportunity cost for career changers is severe. Three years of lost income, plus the substantial debt load, means you’re starting your legal career with a significant financial hole.

Many lawyers don’t reach positive net worth until their mid-30s or even 40s, particularly if they attended expensive schools or took lower-paying public interest positions.

Paralegal and legal support roles offer limited entry points without law degrees, but compensation typically tops out at $60,000-$80,000.

Legal tech companies create some alternative pathways for people with technology skills, but these roles focus on the business of law rather than practicing law itself.

Traditional Finance & Investment Banking: The Pedigree Problem

While financial services broadly has opened to career changers, traditional investment banking and private equity remain stubbornly focused on prestigious institution degrees and conventional career paths.

“Culture fit” often serves as code for preferring candidates who followed the traditional analyst to associate to VP progression. Networking and connections frequently matter more than demonstrable skills, particularly for landing coveted positions at bulge bracket banks.

However, the landscape is shifting:

- Fintech companies value practical skills over institutional pedigree

- Corporate finance departments prioritize results over resume brand names

- Certification programs like the CFA or CFP provide credibility (though requiring 2-4 years of study)

The barrier isn’t insurmountable, but career changers targeting traditional finance should expect to work harder to prove themselves and may need to enter through less prestigious doors before lateral moves to top-tier firms.

Academia & Research: The PhD Barrier

Academic careers present one of the longest timelines for career changers.

Terminal degrees (PhD, MFA, DMA) are required for most faculty positions, representing 5-7 years of doctoral work typically followed by one or more postdoctoral positions.

The financial model is particularly punishing. PhD programs often provide modest stipends of $20,000-$35,000 annually while requiring full-time commitment.

A 40-year-old career changer pursuing an academic position would be nearly 50 before securing a tenure-track job, having spent a decade at poverty-level income.

Assistant tenure-track faculty starting salaries range from $60,000-$80,000 in many fields, significantly lower than what experienced professionals earn in industry. The compensation grows over time, but the initial hit combined with the long preparation period makes this path financially devastating for most career changers.

Alternative pathways exist:

- Career services roles

- Academic administration

- Educational technology

- Instructional design

- Corporate training and development

These positions allow you to work in educational environments without the PhD requirement and financial penalty.

Specialized Engineering & Architecture: The Licensing Labyrinth

Professional engineering licenses require specific educational pathways plus passing multiple exams:

- Fundamentals of Engineering exam

- Accumulating supervised experience (typically 4 years)

- Principles and Practice of Engineering exam

The timeline typically runs 4-6 years minimum.

Architecture presents similar barriers. Most states require a professional degree in architecture (5 years), followed by 3+ years of supervised experience, followed by passing all seven divisions of the Architect Registration Examination.

State-by-state variations in requirements add complexity. A license earned in one state may not transfer easily to another, requiring additional testing or documentation.

These high barriers protect incumbents but effectively lock out career changers unless they’re willing to return to school for years. The financial math rarely works for anyone over 35, as the earning years remaining after licensure don’t justify the investment.

The Strategy: Minimizing Your Career Change Tax

Understanding which industries welcome or penalize career changers is just the first step. These strategies help you minimize your personal switching tax regardless of your target field.

Choose Bridge Industries Strategically

The smartest career changers don’t leap directly from one unrelated field to another. They identify bridge roles that combine elements of their current expertise with skills from their target industry.

Examples of effective bridge strategies:

- Marketing professional to UX design: Take a product marketing role requiring customer research and design team collaboration

- Teacher to corporate training: Start in employee onboarding or learning and development coordination

- Sales to account management: Transition through customer success roles that blend relationship management with technical knowledge

- Engineer to product management: Move into technical program management before full product ownership

These bridge positions allow you to maintain higher compensation while gaining relevant experience. You’re not starting from zero; you’re leveraging existing strengths while building new capabilities.

When choosing your career path strategically, look for roles where your transferable skills provide immediate value.

Project management, communication, analytical thinking, and leadership experience are valuable across virtually every industry. Position these skills as your foundation, with the new technical skills as your growth area.

Leverage Skills-Based Hiring Trends

The shift toward competency-based recruitment creates unprecedented opportunities for career changers who can demonstrate practical abilities. With 81% of employers now using skills-based hiring practices, your non-traditional background matters less than what you can do.

Build a portfolio that showcases actual work:

- Developers: Contribute to open-source projects, build personal apps, complete coding challenges

- Designers: Create spec projects for real companies, redesign existing products, document your process

- Writers: Publish articles on Medium or LinkedIn, create case studies, develop content samples

- Marketers: Document campaign results from side projects, volunteer work, or personal brands

Seek out companies explicitly recruiting career changers. Companies with formal apprenticeship programs, returnship initiatives, or “nontraditional background welcome” language in job descriptions have already made the cultural shift to value diverse experiences.

Emphasize adaptability and fresh perspective as competitive advantages. Career changers bring different problem-solving approaches and don’t carry industry baggage. Frame your varied background as an asset that brings unique value, not a deficiency to overcome.

Timing Your Switch for Maximum Financial Impact

Current market conditions significantly impact your switching premium or penalty. The data shows voluntary turnover has dropped to 13%, suggesting employers have more power than during the Great Resignation period.

The best time to switch:

- When you possess rare or in-demand skills in your target industry

- When your current industry faces long-term decline

- When you’ve built sufficient savings to weather initial pay reduction

- When you have clear evidence of demand in your target sector

The worst time to switch:

- During industry downturns or mass layoffs

- When entering oversaturated fields with surplus candidates

- Before building any relevant skills or credentials

- When you lack financial cushion for transition period

Research labor market trends in your target sector before making the leap. Understanding what salary expectations you should set requires market awareness, not just personal preferences.

Consider switching while employed rather than after leaving your current role. You maintain income during the search and interview from a position of strength. Employers view currently-employed candidates more favorably, and you avoid desperate decision-making driven by financial pressure.

Consider Apprenticeship and Alternative Pathways

Registered apprenticeships have exploded from 360,000 active participants in 2015 to over 667,000 in 2024, according to federal data. These earn-and-learn models reduce the financial strain of switching by providing income during training.

Major companies offering apprenticeship programs for career changers:

- Accenture: Technology consulting apprenticeships

- Google: Software engineering and IT support programs

- LinkedIn: REACH technical apprenticeship

- Airbnb: Six-month paid software engineering program

- Microsoft: Various technology apprenticeships

- Pinterest: Engineering apprenticeships for non-traditional candidates

These programs typically last 6-12 months, combine structured training with real project work, and often convert to full-time positions.

Healthcare, technology, and education sectors are seeing the most explosive apprenticeship growth. California’s $30 million investment in apprenticeship funding specifically targets these high-demand sectors, creating opportunities for career changers in states with strong programs.

Alternative credentials provide faster pathways than traditional degrees:

- 12-week coding bootcamp: $15,000 and 3 months vs. $60,000 and 2 years for computer science master’s

- Professional certifications (PMP, CFA, CFP): 6-24 months of study while working

- Industry-specific certificates: 3-9 months for targeted skill development

- Micro-credentials and digital badges: Weeks to months for specific competencies

The ROI calculation often favors alternative credentials for career changers who need to minimize time and cost of transition.

Negotiate Like a Career Changer (Not a Beginner)

Your experience has value even if it’s not in your target field. The key is translating that value in terms your new employer understands.

Frame your background as bringing valuable perspective:

- Former teacher: Communication, curriculum development, stakeholder management

- Retail manager: Operations, team leadership, customer service excellence

- Military veteran: Leadership, process management, crisis response

- Sales professional: Relationship building, negotiation, business acumen

Research both entry-level AND experienced professional salary ranges to identify a realistic middle ground. You’re not a new graduate, but you’re also not a senior professional in this specific field. Position yourself between these extremes based on your transferable skills.

Our comprehensive guide to the ultimate career change emphasizes negotiating based on total value, not just current qualifications.

Highlight your proven track record, even if it’s from a different industry:

- You’ve already demonstrated professional excellence

- You understand workplace dynamics and professional standards

- You bring mature judgment and decision-making

- You can onboard faster than fresh graduates

Consider total compensation package beyond base salary. Growth trajectory, learning opportunities, mentorship, and career development resources can outweigh a higher starting salary at a company that won’t invest in your growth.

Accept strategic short-term reductions for long-term gain. Taking a 15% pay cut to enter a high-growth industry with strong trajectory makes sense if you’ll exceed your old salary within 2-3 years and have significantly higher earning potential long-term.

Calculate Your Personal Break-Even Point

Before making any career switch, run the complete financial analysis.

Time to recover financially typically spans 3-5 years in welcoming industries. Factor in:

- Immediate pay cuts from switching

- Lost bonuses and incentive compensation

- Reduced benefits (vacation time, insurance, retirement matching)

- Opportunity cost of raises you would have received staying put

Retraining costs must be included in your calculation:

- Bootcamp fees: $10,000-$20,000 typically

- Certification programs: $2,000-$10,000 depending on field

- Degree programs: $30,000-$100,000+ for advanced degrees

- Lost income during full-time study periods

A $15,000 bootcamp plus three months of unpaid study represents roughly $30,000 in total cost when including opportunity cost.

Long-term earning potential in your new field versus current trajectory provides the ultimate comparison:

- If your current industry has limited growth ceiling and you’re approaching it, switching to a higher-ceiling field makes sense even with initial reduction

- If you’re early in a high-growth field, switching incurs massive opportunity cost

- Calculate 10-year earnings projections for both paths to see true financial impact

Non-financial factors matter significantly for most career changers:

- Job satisfaction and daily enjoyment of work

- Work-life balance and flexibility

- Alignment with personal values and purpose

- Growth opportunities and learning

- Company culture and team dynamics

These factors can justify financial penalties that pure math wouldn’t support. Just make the choice with eyes open to the real costs rather than discovering them after it’s too late to reverse course.

Interview Guys Tip: Use the “value translation” strategy in negotiations. For every year of experience in your previous field, demonstrate 2-3 specific ways that experience translates to value in your new role. This positions you as bringing unique assets rather than starting from zero, justifying compensation above entry-level rates.

What the Data Really Means For Your Career Decisions

The $5,000 average career change tax creates a paradox. More companies than ever before welcome career changers through skills-based hiring and apprenticeship programs. Simultaneously, the cooling labor market has reduced the switching premium significantly.

The Opportunity Still Exists (But It’s Changed)

The opportunity exists, but the golden age of job hopping with automatic 15-20% raises has ended. Strategic switching remains possible but requires:

- More thorough planning and research

- More realistic expectations about initial compensation

- More patience during the recovery period

- More strategic industry selection

Industry Selection Matters More Than Ever

Tech, healthcare, and retail sectors accept modest initial reductions in exchange for strong growth trajectories. The barriers are low, the demand is high, and the long-term potential justifies short-term sacrifice.

Finance and consulting allow you to leverage existing business skills to minimize penalties. Your professional acumen transfers more directly, reducing the “starting over” feeling.

Law, medicine, and academia require honest assessment of whether years-long timelines and massive retraining investments make financial sense. For most career changers over 35, the math simply doesn’t work unless passion overrides financial logic.

The Skills-Based Revolution Is Real

The skills-based economy increasingly rewards adaptability over pedigree.

Apprenticeship programs and alternative credentials create pathways that didn’t exist a decade ago. Career changers who position themselves strategically and negotiate effectively can minimize or even eliminate the traditional switching tax.

For those who choose not to change careers, the data provides validation. Median voluntary turnover of just 13% suggests stability has value. Strong performers in growing industries who continuously develop skills may maximize lifetime earnings by staying put and climbing the ladder rather than restarting elsewhere.

Your Personal Math Will Differ

The math works differently for everyone based on:

- Age and career stage

- Financial obligations and family responsibilities

- Risk tolerance and financial cushion

- Personal priorities beyond compensation

- Target industry accessibility

Career change represents an investment of time, money, and opportunity cost. The potential return includes satisfaction, long-term earnings growth, and personal fulfillment.

Break-even typically occurs within 3-5 years in welcoming industries but may never arrive in fortress industries without extensive retraining.

The bottom line: the $5,000 career change tax is real, but it’s not inevitable. Industry selection, timing, and negotiation skills dramatically impact whether you pay a premium, a penalty, or sail through relatively unscathed.

Take Control of Your Career Change Tax

The $5,000 career change tax isn’t about whether to switch careers. It’s about switching strategically so you don’t pay more than necessary.

Choose industries actively recruiting career changers through skills-based hiring and apprenticeship programs. Tech, healthcare, and financial services offer realistic pathways for those willing to invest in relevant skills.

Avoid fortress industries like law and medicine unless you’re prepared for years-long retraining investments that may never generate positive ROI.

Negotiate as someone bringing valuable experience, not as a beginner. Your transferable skills, proven track record, and fresh perspective have real value.

Calculate your personal break-even point before making the leap, factoring in both immediate costs and long-term earning potential.

The data shows career change is more accessible than ever before, but financial realities vary dramatically by industry. Some sectors will cost you $5,000 annually for years. Others will welcome your talents with competitive compensation from day one.

Armed with this knowledge, you can make the switch without paying more career change tax than absolutely necessary. The key is choosing your destination industry as carefully as you choose your departure date.

Tired of Sending Applications Into the Void?

Companies upgraded their screening. Shouldn’t you upgrade your strategy? The IG Network gives you the complete toolkit: The actual ATS parsing tech companies use, access to 70% of jobs never posted online, and AI interview coaching that actually works and a lot more…

BY THE INTERVIEW GUYS (JEFF GILLIS & MIKE SIMPSON)

Mike Simpson: The authoritative voice on job interviews and careers, providing practical advice to job seekers around the world for over 12 years.

Jeff Gillis: The technical expert behind The Interview Guys, developing innovative tools and conducting deep research on hiring trends and the job market as a whole.