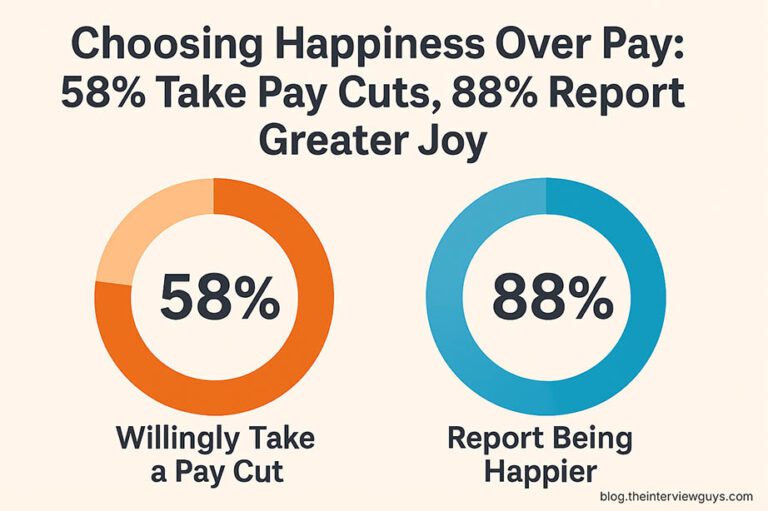

58% of Career Changers Willingly Take a Pay Cut But 88% Report Being Happier: The Surprising Economics of Starting Over

“Follow the money” is the career advice that’s guided generations of professionals. But what if the path to greater fulfillment means temporarily making less? In a surprising twist that defies conventional career wisdom, research shows that 58% of career changers willingly take a pay cut when switching fields — yet an overwhelming 88% report being happier after making the change.

This counterintuitive finding challenges everything we think we know about career economics. At a time when 57.65% of workers are planning a major career change in 2024, understanding the true cost-benefit analysis of starting over has never been more relevant.

The data reveals a profound truth: career satisfaction operates on a different economy than simply maximizing income. For most people contemplating a career pivot, the question isn’t just “can I afford to change?” but rather “can I afford not to?”

☑️ Key Takeaways

- Many career changers willingly accept a pay cut to pursue roles that offer more fulfillment, flexibility, or long-term growth.

- Short-term sacrifice can lead to long-term gain, especially when switching into high-potential or purpose-driven industries.

- Hiring managers don’t always see pay cuts as red flags, especially when candidates clearly explain their motivations.

- Framing your transition around values and future goals helps you stand out as intentional and strategic—not desperate.

The Financial Reality of Career Changes

When considering a career change, the financial impact is typically the first concern for most professionals. According to research from The Motley Fool, over half of career changers accept a pay reduction to switch fields. The higher the previous income, the more likely someone is to take a significant cut, with nearly 75% of those earning $150,000+ accepting lower compensation to pursue a new path.

But how substantial are these pay cuts? Data from the Learning & Work Institute shows career changers face an average pay penalty of £3,731 (approximately $4,700) per year. This represents a significant initial investment in future happiness and career satisfaction.

The financial impact varies dramatically by demographic factors:

- Age: Mid-career changers (around age 39) typically face larger absolute pay cuts but have more financial cushion to absorb them

- Industry: Transitions into healthcare, education, and non-profit sectors see the largest average reductions (10-20%)

- Gender: Women are less likely than men to take pay cuts when changing careers (49% vs. 71%)

- Education level: Those with advanced degrees tend to experience smaller percentage decreases

The Interview Guys Take: The initial pay cut should be viewed as tuition in your new career field. Just like a college degree is an investment that pays dividends over time, the career change “tuition” is an investment in your future earning potential and life satisfaction. The key is ensuring you have enough financial runway to weather the transition period.

For those concerned about the long-term financial implications, research offers reassurance. A LinkedIn survey found that while the initial hit can be substantial, many career changers recover financially within 18-36 months. More importantly, their earning trajectory often accelerates faster than had they remained in their original field, due to increased motivation, engagement, and performance.

The data suggests that career changers should prepare for a financial adjustment period of 1-3 years before potentially surpassing their previous compensation levels. This “transition trough” requires careful financial planning but should be viewed as temporary rather than permanent.

Discover Your Top 8 Perfect Career Matches in 60 Seconds

Take our quick “Career Code” Assessment and get your top 8 career matches. We rank these based on your unique combination of strengths, energy patterns, and motivations

The Happiness Factor

While the financial picture tells one part of the story, the happiness statistics reveal an even more compelling narrative. The Indeed survey reporting that 88% of career changers say they’re happier since making the move represents a staggering success rate for such a significant life change.

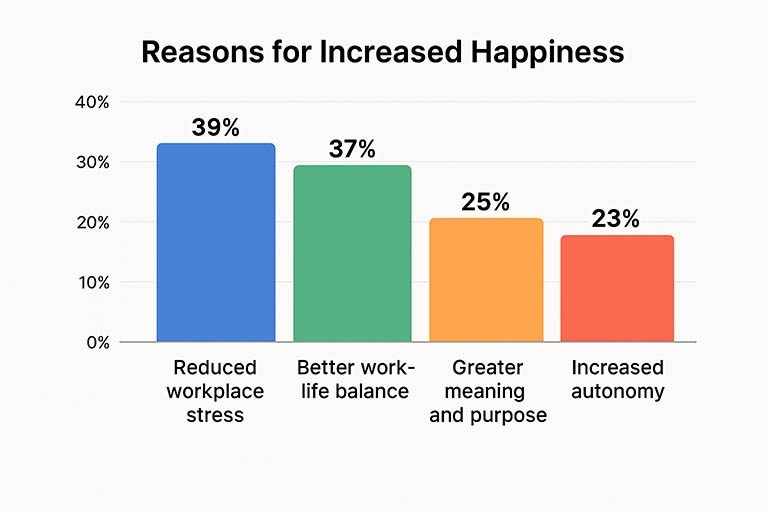

What exactly constitutes this increased happiness? Research breaks it down into several components:

- Reduced workplace stress: 39% cited leaving a stressful job as a primary motivation

- Better work-life balance: 37% reported improved personal time and family relationships

- Greater meaning and purpose: 25% found work that aligned better with their values

- Increased autonomy: 23% gained more control over their daily work

According to Dr. Amy Wrzesniewski, professor of organizational behavior at Yale School of Management, people who view their work as a “calling” rather than just a job report significantly higher life satisfaction. Her research suggests that career changes often involve transitions from viewing work as an obligatory “job” to finding a more personally meaningful “calling.”

The health benefits of increased job satisfaction extend far beyond simple happiness. A meta-analysis published in BMC Public Health found that job dissatisfaction is linked to numerous health problems including depression, anxiety, sleep disorders, and even cardiovascular issues. By contrast, high job satisfaction correlates with better physical health, lower absenteeism, and longer lifespans.

These health benefits represent a hidden economic advantage that rarely factors into career change calculations. Reduced healthcare costs, fewer sick days, and increased energy for side projects or family activities all contribute to the full value equation of career transitions.

The Decision Calculation

The decision to change careers isn’t made lightly. The average person spends approximately 11 months contemplating a career change before taking action. This extended deliberation period reflects the complexity of the decision and the significant barriers many face.

Research from Apollo Technical reveals the top concerns that extend this decision timeline:

- 57% cite financial security as their primary barrier

- 40% are unsure which field to enter next

- 37% worry about lacking proper qualifications

- 31% fear they’re too old to start over

The most successful career transitions typically involve a methodical approach rather than impulsive leaps. According to career change specialists, those who report the highest post-change satisfaction tend to follow a similar pattern:

- Exploration phase: Researching fields of interest while still employed

- Skills assessment: Identifying transferable skills and qualification gaps

- Test driving: Volunteering, freelancing, or part-time work in the new field

- Network building: Connecting with professionals in the target industry

- Financial preparation: Building savings to cover the transition period

- Strategic timing: Planning the move during favorable economic conditions

The Interview Guys Take: The 11-month decision timeline isn’t procrastination—it’s prudent planning. We’ve seen too many clients rush into career changes without proper preparation and end up in the small percentage who regret their move. The most successful career changers we’ve worked with are those who do extensive homework while still collecting paychecks from their current jobs.

The trigger events that finally push people to action are often emotional rather than rational. Major life events like milestone birthdays (especially at age 39-40), health scares, or family changes frequently serve as catalysts. Research from the Bureau of Labor Statistics indicates that workers are 12% more likely to search for new jobs immediately following birthday milestones.

Long-Term ROI Beyond Dollars

For career changers, the return on investment extends far beyond immediate financial metrics. The diverse skills and perspectives gained from working in multiple fields create a unique value proposition that often translates to accelerated advancement in the long run.

According to the Harvard Business Review, professionals with experience in multiple industries develop stronger adaptive capabilities that make them more resilient to economic disruptions and more valuable during times of organizational change. These “career pivoters” typically demonstrate:

- Superior problem-solving abilities from diverse experience

- Stronger communication skills from adapting to different work cultures

- More innovative thinking from exposure to varied methodologies

- Greater resilience during industry-specific downturns

- Enhanced leadership potential from broader perspective

The financial recovery pattern for most career changers follows a J-curve: an initial dip followed by a recovery that eventually exceeds the original trajectory. While specific timelines vary by field, research from PayScale indicates that career changers who leverage transferable skills effectively often surpass their previous earning potential within 4-6 years.

More significantly, the happiness advantage compounds over time. Studies tracking career changers over 5-10 year periods find that the satisfaction gap between those who changed careers and those who remained in unsatisfying jobs widens rather than narrows, suggesting the benefits are sustainable rather than temporary.

Practical Guide for Prospective Career Changers

For those contemplating their own career transitions, research points to several strategies that maximize the chance of ending up in the “88% happy” group while minimizing financial disruption:

1. Financial preparation is essential

- Build a transition fund covering 6-12 months of expenses

- Reduce or eliminate high-interest debt before making the change

- Consider phased transitions (part-time or consulting in both fields) to smooth income

- Research specific salary expectations by field through the Bureau of Labor Statistics

2. Leverage transferable skills to minimize the pay cut

- Conduct a formal skills audit identifying your transferable abilities

- Reframe your resume to emphasize relevant experience for the new field

- Consider certification programs rather than full degrees when possible

- Focus on industries with skills shortages where experience is valued over specific credentials

3. Test before you leap

- Volunteer or freelance in the target field before fully committing

- Take courses or attend workshops to validate your interest

- Shadow professionals in the field to understand day-to-day realities

- Join industry organizations to build networks before needing to job hunt

4. Accelerate the post-change growth curve

- Seek mentorship from experienced professionals in your new field

- Build a learning roadmap focusing on high-value skills

- Network strategically, emphasizing your unique cross-industry perspective

- Document achievements to build credibility quickly

5. Psychological preparation

- Define success metrics beyond salary (work-life balance, engagement, growth)

- Build support systems to navigate the transition emotionally

- Expect and plan for the “transition trough” of uncertainty

- Focus on incremental progress rather than immediate mastery

Conclusion

The statistics tell a compelling story: the economics of career change can’t be measured solely in dollars and cents. The 58% of career changers who accept pay cuts are making a calculated investment in their future happiness—an investment that pays off for the overwhelming majority.

Rather than viewing career transitions as risky departures from sensible financial paths, the data suggests we should reframe them as strategic reallocations of life resources. By investing time and accepting temporary financial setbacks, career changers are purchasing what decades of research confirms money alone cannot buy: meaningful work aligned with personal values and strengths.

Still using an old resume template?

Hiring tools have changed — and most resumes just don’t cut it anymore. We just released a fresh set of ATS – and AI-proof resume templates designed for how hiring actually works in 2025 all for FREE.

Methodology Note: The statistics cited in this article come from multiple research sources including surveys conducted by Indeed, The Motley Fool, CNBC, Learning & Work Institute, and Apollo Technical between 2019-2024. Sample sizes ranged from 1,000 to 5,000 participants across diverse demographics. For purposes of this analysis, “career change” is defined as transitioning to a substantially different field requiring new skills or credentials, not simply changing employers within the same profession.

BY THE INTERVIEW GUYS (JEFF GILLIS & MIKE SIMPSON)

Mike Simpson: The authoritative voice on job interviews and careers, providing practical advice to job seekers around the world for over 12 years.

Jeff Gillis: The technical expert behind The Interview Guys, developing innovative tools and conducting deep research on hiring trends and the job market as a whole.