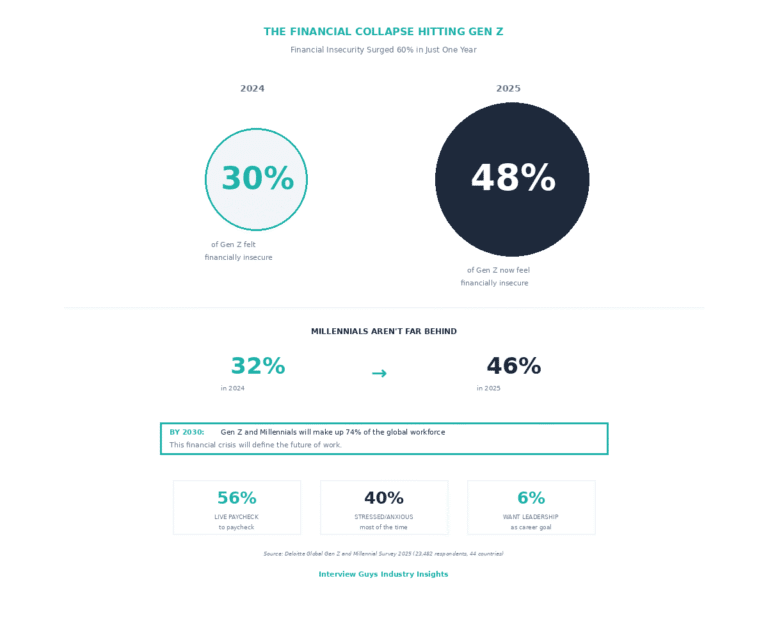

From 30% to 48%: The Financial Collapse Hitting Gen Z Workers

Something broke for young workers in 2024.

In just 12 months, the share of Gen Z workers who feel financially insecure jumped from 30% to 48%. That’s not a gradual shift. That’s a financial earthquake, with nearly half of an entire generation suddenly feeling like the ground has disappeared beneath them.

Deloitte’s 2025 Gen Z and Millennial Survey, which polled over 23,000 respondents across 44 countries, reveals a generation in crisis. They’re not just worried about retirement decades from now. They’re worried about making rent, covering unexpected expenses, and building any kind of financial cushion at all.

And here’s what makes this especially concerning for job seekers: financial insecurity doesn’t just affect your bank account. It affects your mental health, your job performance, and your ability to make smart career decisions.

If you’re a Gen Z or millennial worker feeling the squeeze right now, you’re not alone. By the end of this article, you’ll understand what’s driving this crisis, how it’s affecting the workplace dynamics in 2025, and what concrete steps you can take to build financial stability even in a difficult economy.

☑️ Key Takeaways

- Gen Z financial insecurity surged from 30% to 48% in just one year, representing a 60% increase according to Deloitte’s 2025 global survey of 23,000+ workers.

- Millennials aren’t faring much better, with 46% now feeling financially insecure compared to 32% last year.

- Financial stress directly impacts mental health and job performance, with 40% of Gen Z reporting stress or anxiety most of the time.

- Only 6% of Gen Z workers want leadership roles, prioritizing work-life balance and financial independence over climbing the corporate ladder.

The Numbers Behind the Financial Freefall

Let’s look at the data that reveals just how quickly things have changed for young workers.

The Year-Over-Year Collapse

According to Deloitte’s survey, financial insecurity among Gen Z jumped from 30% in 2024 to 48% in 2025. That’s an 18 percentage point increase, representing a 60% spike in just one year.

| Generation | 2024 | 2025 | Change |

|---|---|---|---|

| Gen Z | 30% felt insecure | 48% feel insecure | +60% increase |

| Millennials | 32% felt insecure | 46% feel insecure | +44% increase |

Together, these two generations, which Deloitte projects will make up 74% of the global workforce by 2030, are entering peak career years with unprecedented financial anxiety.

Living Paycheck to Paycheck

The insecurity isn’t abstract. According to Deloitte’s findings:

- 56% of Gen Z live paycheck to paycheck

- 55% of millennials live paycheck to paycheck

- 30%+ of both groups worry they won’t retire comfortably

- Most can’t cover unexpected expenses or build savings

They’re not building wealth. They’re not preparing for emergencies. They’re surviving month to month.

Interview Guys Tip: If you’re living paycheck to paycheck, you’re not in a position to take calculated career risks like negotiating harder for salary or walking away from a bad job offer. Building even a small emergency fund, just one month of expenses, can give you significant negotiating power in your next job search.

The Mental Health Connection

Financial stress doesn’t stay in its lane. Deloitte found that 40% of Gen Z and 34% of millennials report feeling stressed or anxious all or most of the time. Among those experiencing significant stress, financial concerns rank as the top contributing factor.

| Financial Status | Gen Z Life Satisfaction | Millennial Life Satisfaction |

|---|---|---|

| Financially Secure | 60% satisfied | 68% satisfied |

| Financially Insecure | 28% satisfied | 31% satisfied |

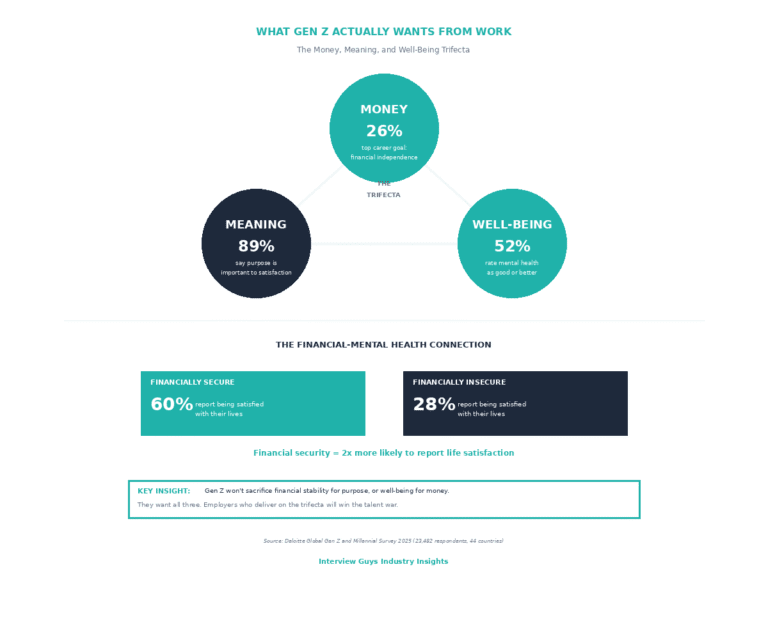

The connection runs both ways. Workers who report feeling financially secure are more than twice as likely to report positive mental well-being.

Why Did This Happen So Fast?

A 60% increase in financial insecurity doesn’t happen without significant underlying causes. Several factors converged to create this crisis.

The Perfect Storm: What’s Driving the Crisis

| Factor | Impact |

|---|---|

| Inflation vs. Wages | Wage growth (2.5%) now trails inflation |

| Frozen Job Market | Hires rate at lowest level since 2013 |

| Entry-Level Collapse | 29% fewer entry-level postings since Jan 2024 |

| Student Debt | Loan payments resumed while costs rose |

| Housing Costs | Rents consuming larger share of income |

Inflation Outpaced Wage Growth

While wages have grown modestly, they haven’t kept pace with the cost of essentials. Housing costs, in particular, have skyrocketed in many markets, consuming an ever-larger share of young workers’ income.

The Indeed Wage Tracker shows advertised wages in job postings grew just 2.5% year-over-year by late 2025, actually running behind inflation. For workers who changed jobs hoping for a raise, the math often didn’t work out.

The Frozen Job Market

As we’ve covered in our analysis of the hiring slowdown, 2025 has been characterized by a “low-hire, low-fire” economy. Companies aren’t laying off workers en masse, but they’re not hiring either.

This creates a particularly difficult situation for Gen Z workers:

- Those trying to enter the workforce face limited opportunities

- Entry-level job postings have declined 29% since January 2024

- Junior tech roles specifically dropped 35%

- Logistics entry positions fell 25%

- Finance entry roles declined 24%

Student Debt Meets Economic Reality

Many Gen Z workers entered the job market carrying significant student loan debt. When combined with a difficult job market and rising living costs, the financial math simply doesn’t work for many young workers.

The promise that education would lead to financial stability has collided with an economy that isn’t delivering on that bargain for many graduates.

How Financial Insecurity Is Reshaping Career Priorities

The financial crisis hitting young workers isn’t just causing stress. It’s fundamentally changing how Gen Z and millennials think about work and careers.

The Death of the Leadership Aspiration

Perhaps the most striking finding from Deloitte’s survey: only 6% of Gen Z say their primary career goal is to reach a leadership position. That’s a dramatic shift from previous generations.

What do they want instead? Financial independence ranked as the top career goal for 26% of Gen Z and 29% of millennials. Work-life balance came in close behind.

This isn’t laziness or lack of ambition. It’s a rational response to watching older workers burn out in management roles that didn’t deliver the financial security they were promised. Gen Z workers are asking: why sacrifice my well-being for a title if it won’t actually make me financially secure?

Purpose Still Matters, But Money Comes First

Despite their financial stress, Gen Z and millennials haven’t abandoned the search for meaningful work. Roughly 89% of Gen Z and 92% of millennials consider a sense of purpose important to their job satisfaction.

But purpose is now one piece of a three-part equation Deloitte calls the “trifecta”: money, meaning, and well-being. Young workers aren’t willing to sacrifice financial stability for purpose, or well-being for money. They want all three, and they’re increasingly unwilling to accept jobs that don’t deliver.

Interview Guys Tip: When evaluating job offers, think beyond just the salary. Consider the full compensation picture: benefits, retirement matching, health insurance, and flexibility. These elements often determine your true financial security more than base pay alone.

Job Hopping as Survival Strategy

Gen Z’s average job tenure now sits at just 1.1 years according to Randstad data, compared to 1.8 years for millennials and 2.8 years for Gen X. Critics call this job hopping. Young workers call it survival.

When raises barely keep pace with inflation and promotions are scarce, changing jobs remains one of the few reliable ways to increase income. The stigma of job hopping has largely evaporated as employers have demonstrated that loyalty runs only one direction.

The Mental Health Toll of Financial Stress

Financial insecurity doesn’t just affect your wallet. It affects your brain, your relationships, and your ability to perform at work.

The Stress Epidemic

Deloitte found that 40% of Gen Z workers feel stressed or anxious all or most of the time. A separate Seramount study found that 77% of millennials and 72% of Gen Z report experiencing at least one symptom of burnout.

Top Workplace Stress Drivers (among those whose job contributes to stress):

- 48% cite long working hours

- 48% cite not being recognized or rewarded adequately

- 44-45% cite toxic workplace cultures

- Financial worries rank as the #1 overall stress contributor

When Mental Health Affects Work

Financial and mental health struggles don’t stay outside the office. According to SHRM research, 68% of Gen Z workers say their mental health has impacted their ability to work effectively.

The math is brutal: workers need to perform well to earn more money, but financial stress makes it harder to perform well. Breaking this cycle requires both individual strategies and systemic support.

The Support Gap

Despite increased awareness of mental health issues, many young workers still don’t feel comfortable seeking help:

| Metric | Gen Z | Millennials |

|---|---|---|

| Comfortable talking to manager about mental health | 62% | 64% |

| Worry manager would discriminate | 26% | 26% |

| Have needed time off for stress | 74% | 68% |

| Actually took that time off | 43% | 37% |

The gap between needing support and actually getting it remains significant.

What Gen Z and Millennials Can Do About It

Understanding the problem is important, but solutions matter more. Here are concrete steps young workers can take to build financial stability even in a difficult environment.

Your Financial Stability Action Plan

| Priority | Action | Why It Matters |

|---|---|---|

| 1 | Build $1,000 emergency fund | Prevents minor crises from becoming catastrophes |

| 2 | Get full 401(k) match | Free money you’re leaving on the table |

| 3 | Negotiate every offer | 5% more on $50K = $2,500/year |

| 4 | Build high-value skills | AI skills command 20-30% premiums |

| 5 | Consider geographic arbitrage | $70K in low-cost city > $100K in expensive metro |

Build Your Emergency Fund First

Before aggressive investing or debt payoff, focus on building a small emergency fund. Even $1,000 can prevent a minor crisis from becoming a financial catastrophe. Aim eventually for three to six months of essential expenses.

This isn’t just about money. Having a financial cushion gives you psychological freedom:

- You can walk away from a toxic job

- You can negotiate harder on salary

- You can take a calculated risk on a career change

- You can wait for the right opportunity instead of taking the first offer

Maximize Free Money

If your employer offers a 401(k) match, contribute at least enough to get the full match. This is literally free money, and skipping it leaves compensation on the table.

Other benefits to maximize:

- Health Savings Accounts (HSA) for triple tax advantages

- Commuter benefits for pre-tax transit costs

- Educational reimbursement for skill building

- Employee stock purchase plans at discounted rates

These benefits effectively increase your compensation without costing you additional taxes.

Negotiate Strategically

Many young workers leave money on the table by not negotiating salary offers. Research shows that women and younger workers are particularly likely to accept initial offers without negotiation.

Even a modest 5% increase on a $50,000 salary means an extra $2,500 per year. Over a decade with raises, that initial negotiation could be worth tens of thousands of dollars.

Invest in High-Value Skills

Not all skills are equally valuable in the job market. Focus your professional development on skills that command premium pay.

Skills with the highest salary premiums in 2025:

- AI and machine learning proficiency (20-30% premium)

- Data analysis and visualization

- Project management certification (PMP)

- Cloud computing (AWS, Azure, GCP)

- Cybersecurity fundamentals

According to multiple studies, AI skills now command significant salary premiums. Workers who can demonstrate proficiency with AI tools often earn 20-30% more than peers in similar roles.

Interview Guys Tip: Free learning platforms like LinkedIn Learning, Google Certificates, and Coursera offer courses that can genuinely boost your earning potential. Even 30 minutes a day of skill building adds up over time and makes you more marketable in your next job search.

Consider Geographic Arbitrage

With remote work still an option for many roles, consider whether you could reduce living costs by relocating. The cities with the best salary-to-cost-of-living ratios often aren’t the ones that immediately come to mind.

A $70,000 salary in a low-cost city often provides better quality of life than $100,000 in an expensive metro. This kind of move isn’t for everyone, but it’s worth considering if financial stability is your priority.

What This Means for Employers

The financial insecurity crisis hitting Gen Z and millennials isn’t just an individual problem. It’s an organizational challenge that smart employers are already addressing.

What Young Workers Want from Employers

| What They Want | What They’re Getting | The Gap |

|---|---|---|

| Financial stability support | Ping-pong tables | Massive |

| Strong 401(k) match | Basic benefits | Significant |

| Transparent pay | Salary secrecy | Widening |

| Mental health resources | Lip service | Critical |

| Career development | Stalled promotions | Growing |

Competitive Pay Is Table Stakes

Companies that don’t offer competitive wages will struggle to attract and retain talent from these generations. Young workers are increasingly sophisticated about researching market rates and aren’t afraid to leave for better pay.

Benefits Matter More Than Perks

Forget ping-pong tables and cold brew on tap. Gen Z workers want benefits that address their financial anxiety:

- Strong 401(k) matches (6%+ employer contribution)

- Comprehensive health insurance with low deductibles

- Emergency savings programs with employer matching

- Student loan repayment assistance

- Financial wellness education

These practical benefits beat flashy perks every time.

Transparency Builds Trust

With salary transparency laws spreading across the country, companies that proactively embrace pay transparency will have an advantage in recruiting. Young workers increasingly expect to know what a job pays before they apply.

Putting It All Together

The financial collapse hitting Gen Z workers isn’t a minor concern or a generational quirk. A 60% increase in financial insecurity in a single year represents a genuine crisis that’s reshaping how an entire generation approaches work and careers.

Key Takeaways

- The problem is real and systemic. You’re not imagining things. Financial insecurity has genuinely spiked among young workers, driven by a frozen job market, wage growth that trails inflation, and rising costs of essentials.

- Financial stress affects everything. Your mental health, your job performance, and your career decisions are all influenced by financial anxiety. Addressing the root cause, building actual financial stability, is essential.

- Individual action still matters. While systemic changes are needed, you don’t have to wait for them. Building emergency savings, negotiating strategically, and investing in high-value skills can all improve your financial position.

- Your priorities aren’t wrong. Wanting financial stability, work-life balance, and meaningful work isn’t unreasonable. It’s a rational response to an economy that has broken many traditional bargains about work and reward.

Your Next Steps

- This week: Calculate your current savings rate and set a target

- This month: Review your benefits and ensure you’re maximizing free money

- This quarter: Identify one high-value skill to develop

- This year: Build toward a one-month emergency fund minimum

The path forward isn’t easy, but it exists. Build your skills, build your savings, and build your network. In a challenging economy, these fundamentals matter more than ever.

For more guidance on navigating your career in 2025, check out our complete job search strategy guide and learn how to negotiate salary even without experience.

The reality is that most resume templates weren’t built with ATS systems or AI screening in mind, which means they might be getting filtered out before a human ever sees them. That’s why we created these free ATS and AI proof resume templates:

Still Using An Old Resume Template?

Hiring tools have changed — and most resumes just don’t cut it anymore. We just released a fresh set of ATS – and AI-proof resume templates designed for how hiring actually works in 2026 all for FREE.

BY THE INTERVIEW GUYS (JEFF GILLIS & MIKE SIMPSON)

Mike Simpson: The authoritative voice on job interviews and careers, providing practical advice to job seekers around the world for over 12 years.

Jeff Gillis: The technical expert behind The Interview Guys, developing innovative tools and conducting deep research on hiring trends and the job market as a whole.