The Fractional Leadership Paradox: Why Executives With No Official Title Now Control $5.7B in Corporate Decisions

Corporate America is conducting a massive governance experiment, and almost nobody realizes it’s happening.

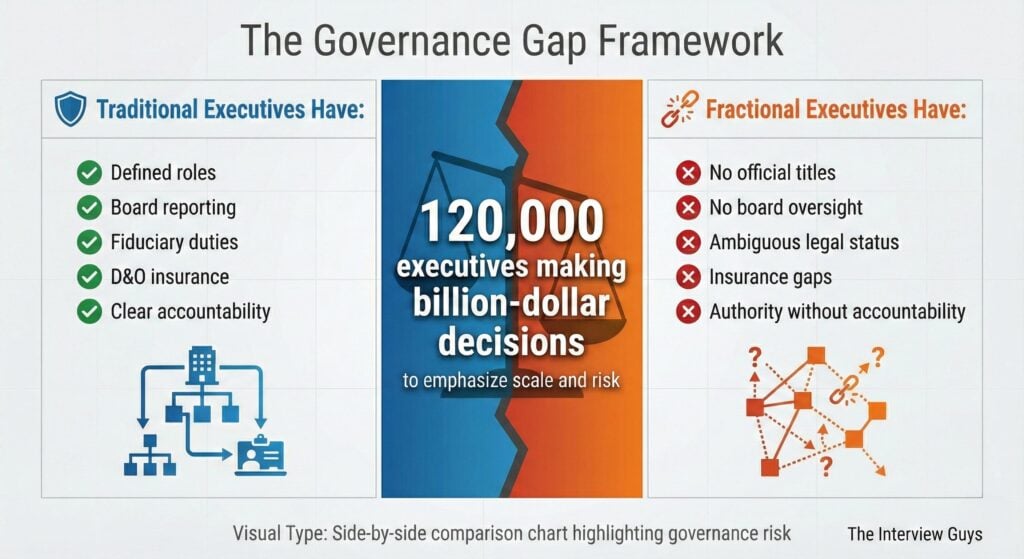

Right now, 120,000 fractional executives are making C-level decisions for companies across the United States. They control budgets running into millions of dollars. They hire and fire employees. They set strategic direction. They sign contracts. They shape operational execution and risk management.

Here’s the problem: most of them don’t officially work for the companies they’re running.

The $5.7 Billion Blind Spot

The fractional executive market has exploded into a $5.7 billion industry growing at 14% annually. The numbers tell a stunning story:

- Market doubled in two years: From 60,000 fractionals (2022) to 120,000 (2024)

- LinkedIn profiles surged 5,400%: From 2,000 in 2022 to 110,000 in early 2024

- Gartner’s projection: By 2027, nearly one-third of midsize companies will employ at least one fractional executive

But this rapid adoption has created something unprecedented: a massive governance gap that nobody’s talking about.

These executives shape strategic decisions and operational execution for the companies that hire them. Yet they hold no official positions within those organizations.

They don’t appear on org charts. They often work on 1099 contractor status. And the legal framework governing their authority and accountability is, at best, ambiguous.

Think about what this actually means:

When a fractional CFO makes a financial decision that costs a company millions, who’s liable?

When a fractional CMO signs a marketing contract that goes sideways, who’s accountable?

When a fractional CTO implements a system that leads to a data breach, who faces the consequences?

The answer isn’t clear, and that should concern everyone from boards to shareholders to the executives themselves.

How We Got Here

The fractional executive model didn’t start as a governance nightmare. It emerged as a practical solution to a real business problem.

The original value proposition was simple:

- Companies get executive-level expertise without full-time salary costs

- Experienced leaders get flexibility and portfolio careers

- Everyone saves money while accessing specialized skills

And it worked spectacularly.

Private equity firms discovered fractional executives could save them up to 60% compared to full-time hires while delivering 20-30% better returns on portfolio companies.

Startups found they could access senior talent during critical growth phases without burning cash.

Mid-sized companies could bring in specialists for specific projects without long-term commitments.

The model proved so effective that it doubled in size in just two years. From 60,000 fractional leaders in 2022 to 120,000 in 2024.

But nobody stopped to ask the hard question: what happens when people making executive decisions aren’t actually executives?

The Authority Without Accountability Problem

Traditional corporate governance relies on clear lines of authority and responsibility.

Executives have:

- Defined roles

- Board reporting requirements

- Fiduciary duties

- D&O insurance coverage

- Personal liability for negligence or misconduct

Fractional executives exist in a legal gray area.

According to research on legal issues companies should consider when hiring fractional leaders, most fractional executives work as independent contractors, either as sole proprietors or through their own legal entities.

This classification creates immediate complications:

The Control Paradox

Companies hire fractional executives specifically because they need someone to make decisions and drive outcomes. But under independent contractor law, if a company exercises too much control over how, when, and where work is completed, the worker may be reclassified as an employee.

This creates a catch-22: Companies need executive-level control but can’t legally exert it without triggering employee reclassification.

The Agency Problem

When fractional executives sign contracts, make hiring decisions, or commit company resources, are they acting as agents of the company?

Legal precedent shows that independent contractors can create binding obligations for companies through apparent authority, even without formal employment relationships. But most fractional executive contracts don’t clearly define the scope of this authority.

The Insurance Gap

D&O insurance is designed to protect full-time executives from personal liability for decisions made in their official capacity. But fractional executives often aren’t covered by their clients’ D&O policies.

Some carry their own professional liability insurance. Many don’t.

This leaves a liability gap where neither party is clearly protected.

The Governance Vacuum

Here’s what keeps corporate attorneys up at night: fractional executives are making decisions that would typically require board oversight, but they’re not subject to the same governance mechanisms as traditional executives.

Real Scenarios Happening Right Now

Scenario 1: The Fractional CFO

A fractional CFO at a mid-sized manufacturing company decides to change accounting firms and implement new financial controls. This decision affects audit integrity, investor relations, and regulatory compliance.

But because the CFO is a contractor, they:

- Don’t attend board meetings

- Aren’t subject to the same disclosure requirements

- May not even be mentioned in company filings

Scenario 2: The Fractional CMO

A fractional CMO launches a major rebranding initiative and signs a multi-million dollar contract with an agency. The campaign fails spectacularly, damaging the company’s reputation and wasting significant resources.

The fractional CMO moves on to their next client. The company is left dealing with the fallout. The lines of accountability are murky at best.

Scenario 3: The Fractional CTO

A fractional CTO implements a new technology stack without proper security reviews. Six months after their engagement ends, the company discovers a major vulnerability that leads to a data breach.

Who’s responsible?

- The company for inadequate oversight?

- The fractional CTO for negligent implementation?

- Their LLC that provided the services?

These aren’t hypothetical scenarios. They’re the logical outcomes of a system where authority and accountability don’t align.

The Legal Patchwork

The legal framework governing fractional executives is essentially non-existent. Instead, companies and executives navigate a patchwork of general business law principles that were never designed for this model.

Under traditional agency law, principals can be held liable for the actions of their agents. But fractional executives occupy an ambiguous position:

- They’re not employees, so respondeat superior (vicarious liability) typically doesn’t apply

- They’re contractors, but they’re making executive-level decisions that go far beyond typical contractor scope

According to research on corporate governance and executive accountability, executives and directors at large corporations rarely face personal liability for failures of oversight. But this assumes a traditional employment structure with clear fiduciary duties and insurance protections.

For Fractional Executives, The Rules Are Unclear

Fiduciary duties:

Do fractional executives owe fiduciary duties to the companies they serve?

- Traditional law says directors and officers have duties of care and loyalty to their companies

- But fractional executives aren’t directors or officers in the legal sense

- Some argue they should be held to the same standards based on their de facto authority

- Others contend their contractor status exempts them

Professional liability:

If a fractional executive makes a negligent decision, can they be held personally liable?

The answer depends on:

- The terms of their contract

- The nature of the work

- Whether they carry professional liability insurance

- The specific jurisdiction

In other words, nobody really knows until it goes to court.

Misclassification risk:

Companies that exercise significant control over fractional executives may face worker misclassification claims. Courts have held that if an employer dictates how, when, and where work is completed, the worker is legally an employee regardless of what their contract says.

For companies genuinely needing executive-level decision-making authority, this creates significant risk.

The Succession Planning Nightmare

Traditional executive succession planning assumes continuity. When a CFO leaves, there’s typically a transition period, knowledge transfer, and clear handoff of responsibilities.

Fractional executives operate on entirely different timelines:

- Average engagement length: Exactly 12 months

- Simultaneous companies: Average of 4.3 per executive

- Client acquisition method: 73% through networking and referrals, not formal vetting

This creates succession challenges that traditional governance frameworks weren’t built to handle.

The questions nobody’s answering:

What happens to institutional knowledge when a fractional executive moves on?

Who’s responsible for decisions made during their tenure?

How do companies maintain strategic continuity when leadership is intentionally temporary?

The Informal Hiring Problem

More concerning: 73% of fractional client acquisition comes through networking and referrals, not formal vetting processes.

Companies are hiring executives who will make million-dollar decisions based primarily on word-of-mouth recommendations:

- No background checks

- No board interviews

- No formal onboarding

This informal hiring process works fine until something goes wrong. Then companies discover they don’t have the documentation, oversight mechanisms, or legal protections they assumed existed.

The D&O Insurance Problem

Directors and Officers insurance exists to protect executives from personal liability for decisions made in good faith while serving in their official capacity. It’s a critical component of modern corporate governance.

But fractional executives create a coverage nightmare.

The Coverage Gap

Most D&O policies are written assuming traditional executive employment relationships. They cover “directors and officers” as those terms are legally defined.

Fractional executives, working as independent contractors, often fall outside these definitions.

The Assumption Problem

- Companies assume: Their fractional executives carry their own professional liability insurance

- Fractional executives assume: They’re covered by their clients’ D&O policies

- Reality: In many cases, both assumptions are wrong

This creates a coverage gap where nobody’s actually protected.

Legal experts advising on fractional general counsel arrangements note that companies in high-compliance industries like healthcare, fintech, and cannabis need to be particularly careful about insurance and liability questions.

But these concerns apply equally across all industries where fractional executives make consequential decisions.

The insurance industry hasn’t caught up to this new reality:

- Policies need to be rewritten

- Companies need to explicitly verify coverage

- Fractional executives need to understand their exposure

Right now, everyone’s operating on assumptions that may not hold up when tested.

What Happens When Things Go Wrong

The real test of any governance system comes when something fails. And failures are inevitable when you have 120,000 executives making decisions across hundreds of thousands of company relationships.

So far, most fractional executive failures have been handled quietly through contract disputes, settlements, and informal resolutions. But as the industry scales, high-profile failures are coming.

Likely Scenarios Coming Soon

The Pre-IPO Accounting Disaster

A fractional CFO at a pre-IPO company makes accounting decisions that later prove to be violations of SEC regulations. The company faces penalties and investor lawsuits.

- The CFO claims: They were following the company’s direction and are protected by contractor status

- The company claims: The CFO had independent authority and should be personally liable

- The court: Has no clear precedent

The Unapproved Marketing Contract

A fractional CMO signs a marketing contract that includes an indemnification clause the company didn’t approve. When the relationship goes south, the vendor sues both the company and the fractional CMO personally.

- The fractional CMO’s insurance: Doesn’t cover contractual obligations

- The company’s insurance: Doesn’t cover contractor agreements

- The result: Everyone ends up in litigation

The GDPR Violation

A fractional CTO implements a system that inadvertently violates GDPR or other data privacy regulations. The regulatory penalties are severe.

But who’s responsible?

- The CTO who designed it?

- The company that deployed it?

- The CTO’s consulting firm that provided the services?

These scenarios aren’t far-fetched. They’re the predictable outcomes of a governance system that hasn’t been updated for fractional leadership.

The Path Forward

The fractional executive model isn’t going away. It’s too valuable and too well-established. But the governance gap needs to be addressed before a major crisis forces emergency regulation.

What Needs to Happen

1. Companies Need Better Contracts

Standard independent contractor agreements aren’t sufficient for executives making strategic decisions. New contract templates should explicitly address:

- Authority limits

- Decision-making protocols

- Insurance requirements

- Indemnification terms

- Dispute resolution mechanisms

2. Insurance Industry Needs Fractional-Specific Coverage

This could take the form of:

- Specialized D&O riders that explicitly cover contractor executives

- New professional liability products designed for fractional leadership

Either way, the coverage gaps need to be closed.

3. Boards Need Oversight Protocols

If a fractional executive has authority equivalent to a full-time C-suite member, they need equivalent oversight:

- Board reporting requirements

- Regular performance reviews

- Formal approval processes for major decisions

4. Professional Associations Need Standards

The fractional executive industry is largely unregulated, but that doesn’t mean it needs to stay that way. Industry-led standards could provide the framework currently missing:

- Codes of conduct

- Insurance minimums

- Contract best practices

- Governance requirements

5. Legislators Need to Clarify Legal Status

Right now, the law treats fractional executives as independent contractors because that’s the closest existing category.

But their actual function is more like temporary officers. The legal framework should reflect this reality.

The Accountability Question Nobody’s Asking

Here’s the fundamental question at the heart of this governance paradox:

If fractional executives have the authority to make executive decisions, shouldn’t they also have executive accountability?

Right now, the answer is no.

They have:

- Authority without accountability

- Power without oversight

- Influence without transparency

This works fine when everything goes smoothly. But governance systems aren’t designed for smooth sailing. They’re designed for storms.

The Stakes Are Too High to Ignore

The fractional executive model has grown from a niche solution to a $5.7 billion industry in just a few years. It’s projected to become the default leadership model for 30% of midsize companies within three years.

That’s too big, too fast, and too important to operate in a governance vacuum.

Companies are making a trillion-dollar bet that this model will work without formal oversight mechanisms.

Executives are betting their reputations and potentially their personal assets on ambiguous legal protections.

Boards are betting they won’t be held liable for decisions made by people who don’t technically work for them.

Those are risky bets, and they’re all based on the assumption that nothing will go seriously wrong.

The Bottom Line

The fractional executive revolution is real and it’s here to stay. But it’s being built on a foundation of governance assumptions that don’t actually exist.

Right now:

- 120,000 executives are making billion-dollar decisions

- Without clear authority frameworks

- Without accountability mechanisms

- Without liability protections

They’re signing contracts, hiring employees, setting strategy, and managing risk for companies they don’t officially work for.

This is the governance equivalent of building a skyscraper without checking if the foundation can support the weight.

When Will the Reckoning Come?

Eventually, something will test these assumptions:

- A major company will face a crisis caused by fractional executive decisions

- A high-profile lawsuit will expose the liability gaps

- A regulatory investigation will reveal the oversight deficiencies

When that happens, the entire industry will be forced to reckon with the governance paradox it’s been ignoring.

The question is whether we’ll address these issues proactively or wait for a disaster to force our hand.

What This Means for Your Career

For job seekers considering how to change careers in 2025, fractional executive work represents a significant opportunity, but one that comes with legal and professional risks that need to be understood.

For companies exploring the rise of human-AI collaboration and other workforce trends, the fractional model offers flexibility but requires serious governance updates.

As remote work continues to reshape how companies operate, with highest-paying remote jobs increasingly including fractional executive roles, and as we look toward the best jobs for the future, the fractional model will only become more prevalent.

Those preparing for executive interview questions should understand this landscape is changing rapidly. Our State of Job Search 2025 research report shows that flexible work arrangements, including fractional roles, are reshaping career trajectories across industries.

The Final Question

The fractional executive model is here to stay. But the governance framework supporting it needs serious work.

The $5.7 billion question is whether we’ll build that framework before or after the first major crisis exposes how fragile the current system really is.

BY THE INTERVIEW GUYS (JEFF GILLIS & MIKE SIMPSON)

Mike Simpson: The authoritative voice on job interviews and careers, providing practical advice to job seekers around the world for over 12 years.

Jeff Gillis: The technical expert behind The Interview Guys, developing innovative tools and conducting deep research on hiring trends and the job market as a whole.